- 93 Companies reviewed

- 50 Features considered

- 4,650 Data points analyzed

We collected 4,650 data points from 93 life insurance companies to measure financial stability, customer satisfaction, product and feature variety, and the overall buying experience. We then evaluated each company based on 50 metrics to develop unbiased, comprehensive reviews.

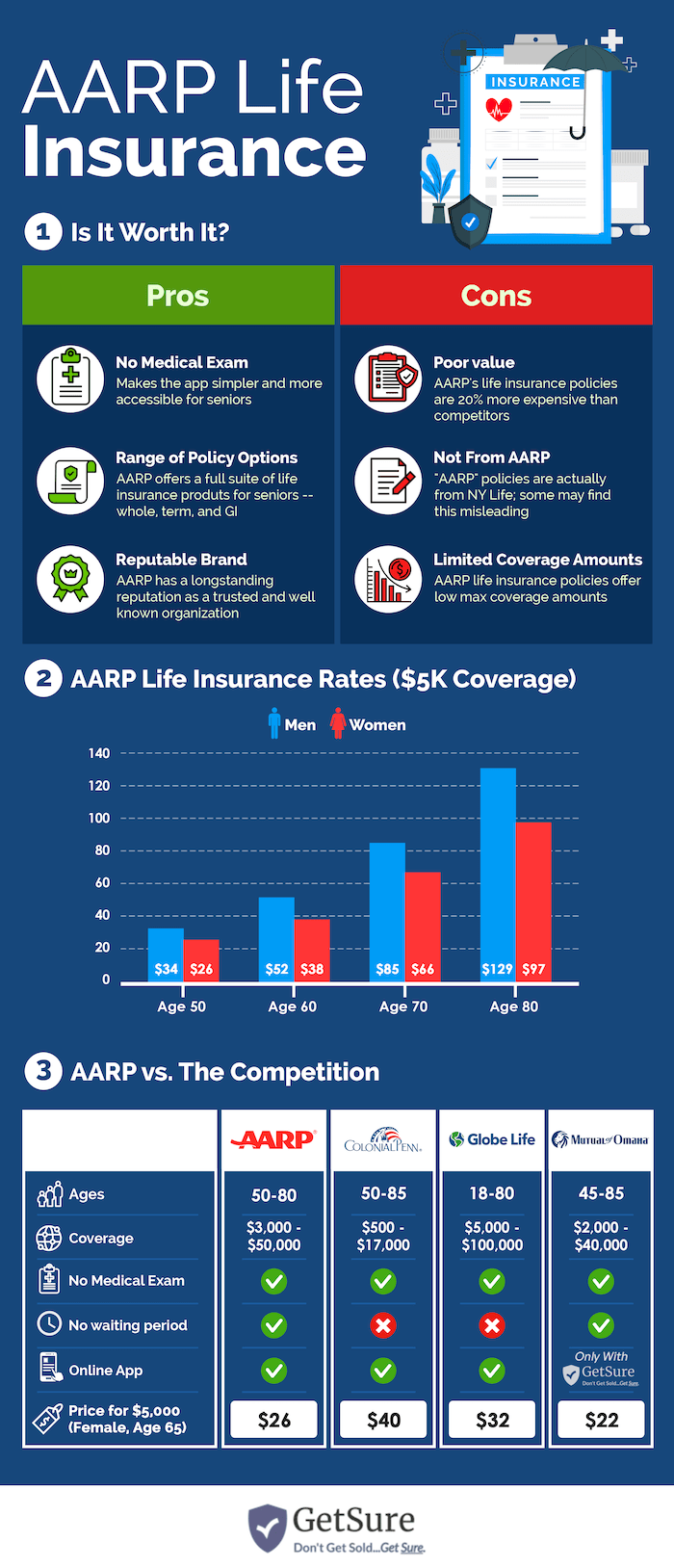

AARP Life Insurance is a New York Life Insurance Company product for AARP members. AARP is a non-profit organization that provides services, advocacy, and information to people over 50. The AARP final expense insurance program is designed to help older adults and their families protect their financial future by providing different life insurance options. In this review, we will take a closer look at the three main types of life insurance through AARP: Level Benefit Term Life, Guaranteed Acceptance Life, and Permanent Life.

Choose kindness.

You never know what battles people may be fighting.

Level Benefit Term Life Insurance

Level Benefit Term Life Insurance with AARP is a type of life insurance that provides coverage for a specified period, usually 10, 15, or 20 years and pays a fixed benefit amount if the insured passes away during that period. This type of insurance is designed to provide financial protection to families if the primary breadwinner dies prematurely.

The premiums for Level Benefit Term Life Insurance are typically lower than other types of life insurance, making it an affordable option for many families. AARP Level Benefit Term Life Insurance covers individuals aged 50-74, ranging from $10,000 to $100,000. The premiums for this type of insurance are based on the insured’s age, gender, health status, coverage amount, and term length.

The premiums are guaranteed to remain the same throughout the policy term, which provides peace of mind and financial stability to the insured and their family. One of the advantages of AARP Level Benefit Term Life Insurance is that it is underwritten by New York Life Insurance Company, a reputable and financially stable company with over 175 years of experience in the insurance industry.

New York Life Insurance Company has an A++ rating from A.M. Best, which is the highest possible rating and indicates that the company has a superior ability to meet its financial obligations.

Guaranteed Acceptance Life Insurance

Guaranteed Acceptance Life Insurance does not require a medical exam or health questionnaire, making it a good option for individuals who may not qualify for other types of life insurance due to their health status. The coverage amounts for Guaranteed Acceptance Life Insurance are typically lower than other types of life insurance, and the premiums are higher. AARP Guaranteed Acceptance Life Insurance covers individuals aged 50-80, ranging from $2,500 to $25,000.

The premiums for this type of insurance are based on the insured’s age and gender and are guaranteed to remain the same throughout the policy’s life. This provides the insured and their family peace of mind and financial stability. One of the disadvantages of AARP Guaranteed Acceptance Life Insurance is that it has a two-year waiting period before the full death benefit is payable.

Suppose the insured passes away during the first two years of the policy. In that case, the beneficiary will receive a reduced death benefit, typically equal to the premiums paid up to that point. However, the full death benefit is payable after the two-year waiting period.

Choose kindness.

You never know what battles people may be fighting.

Permanent Life Insurance

Does AARP offer whole life insurance/permanent life insurance? As mentioned earlier, it’s one of its best-known products. Permanent Life Insurance is a type of life insurance that provides coverage for the insured’s entire lifetime as long as premiums are paid. This type of insurance has a cash value component that can grow over time and be accessed by the policyholder.

The AARP permanent life insurance cash value component can be used for various purposes, such as paying for college tuition, buying a home, or supplementing retirement income. AARP Permanent Life Insurance covers individuals aged 50-80, ranging from $2,500 to $50,000. The premiums for this type of insurance are based on the insured’s age, gender, health status, and coverage amount.

AARP Permanent Life Insurance premiums are higher than those for Level Benefit Term Life Insurance but lower than those for Guaranteed Acceptance Life Insurance. One of the advantages of AARP Permanent Life Insurance is that it has a cash value component that can grow over time and be accessed by the policyholder.

The policyholder can borrow against the cash value or withdraw it, and the cash value can also be used to pay premiums. However, it is important to note that borrowing against the cash value reduces the death benefit payable to the beneficiary.

Comparison of AARP Life Insurance Options

| Type of Insurance | Coverage Amounts | Premiums | Waiting Period | Cash Value Component |

|---|---|---|---|---|

| Level Benefit Term Life | $10,000-$100,000 | Guaranteed | N/A | N/A |

| Guaranteed Acceptance Life | $2,500-$25,000 | Higher Premium | 2 years | N/A |

| Permanent Life | $2,500-$50,000 | Higher Premium | N/A | Yes |

The above table summarizes the key features of the three main types of life insurance offered by AARP. As shown in the table, when it comes to Level Benefit Term Life Insurance policy from AARP, no waiting period is required, while Guaranteed Acceptance Life Insurance has a two-year waiting period before the full death benefit is payable. Permanent Life Insurance has no waiting period, but the premiums are higher than those for Level Benefit Term Life Insurance. All three types of insurance cover individuals aged 50-80, but the coverage amounts and premiums vary.

Who Is NYLAARP Life Insurance Good For?

AARP Life Insurance is a program offered by New York Life Insurance Company to AARP members to help them protect their financial future. The program offers three main types of life insurance: Level Benefit Term Life, Guaranteed Acceptance Life, and Permanent Life. Each type of insurance has advantages and disadvantages, and insurance choice depends on the insured’s needs and circumstances.

Level Benefit Term Life Insurance is a good option for individuals who want affordable coverage for a specified period, while Guaranteed Acceptance Life Insurance is a good option for individuals who may not qualify for other types of life insurance due to their health status. Permanent Life Insurance provides coverage for the insured’s entire lifetime, as long as premiums are paid, and has a cash value component that can grow over time and be accessed by the policyholder.

Choose kindness.

You never know what battles people may be fighting.

AARP Burial Insurance: 3rd-Party Ratings

One of the best ways to size up a company is to look at its third-party ratings.

Financial Strength Ratings

The preeminent ratings company in the insurance industry is A.M. Best. A.M. Best ratings measure an insurance company’s claims-paying ability.

NY Life AARP insurance carrier currently holds a rare A++ (Superior) rating.

This is A.M. Best’s highest possible financial strength rating among its 19 separate rating categories (A++ to D).

Better Business Bureau (BBB) Ratings

The Better Business Bureau (BBB) is an organization that has been rating a company’s business practices since 1912. The BBB provides tools for consumers to research companies and find reputable organizations they can trust. While A.M. Best ratings are based on a life insurer’s financial performance, BBB ratings are based on the complaints filed against a company and provide an indication of customer service quality.

New York Life holds an A- rating from the BBB, while AARP carries an A+ rating.

AARP Life Insurance FAQs

Does AARP cover burial?

AARP burial insurance is permanent life insurance, available to AARP members between 50 and 80 years of age. The AARP death benefit payout ranges from $2.5K to $50K and your beneficiary can use your life insurance policy’s payout for any purpose whatsoever, including funeral expenses, cremation costs, or even unpaid medical bills. But how much is AARP life insurance, really? The AARP burial insurance rates go from $11-$360, depending on age and gender.

Does AARP life insurance end at age 80?

Absolutely not. AARP funeral insurance is permanent life insurance (whole life insurance), which means that your coverage never ends as long as you pay your premiums. However, coverage under AARP’s term life insurance product DOES end at 80. AARP guarantees its term life policyholders the option to exchange their coverage for permanent life insurance when they reach age 80. While your premiums may change, you will not have to take a medical exam or answer any health questions.

Is New York Life legit?

Absolutely. New York Life is a highly reputable life insurance carrier that has been issuing policies and successfully paying claims since 1841! That’s a track record of over 175 years. On top of this, A.M. Best, a company that rates insurance carriers’ ability to pay claims, gives New York Life its top rating, a rare A++ (Superior).

Conclusion & Key Takeaways

AARP life insurance and the company’s track record of customer satisfaction are unmatched among American membership organizations, on par with AAA. While your monthly premium payments may be slightly higher with AARP than with other final expense insurance companies, AARP’s reputation for customer satisfaction and New York Life’s industry-leading financial strength (A++ A.M. Best rating) could make this worth it.

We hope you enjoyed this review of funeral insurance AARP products. If you have any additional questions, don’t hesitate to comment here or email us at [email protected].

Warm Regards,

The GetSure Team

Article Sources

- Better Business Bureau. New York Life Insurance Company

- Better Business Bureau. AARP

- AARP. AARP Guaranteed Life Insurance From New York Life

- AARP. AARP Permanent Life Insurance From New York Life

- AARP. AARP Term Life Insurance From New York Life