Colonial Penn Life Insurance

- Permanent coverage: your coverage never expires and cannot be canceled

- Flat rates: unlike players like Globe and AARP, Colonial Penn's rates are fixed

- Guaranteed acceptance: no medical exams or health questions

- Price: the $9.95 plan can be one of the most expensive options on the market

- Waiting period: the full death benefit is only available after 2 years

- 93 Companies reviewed

- 50 Features considered

- 4,650 Data points analyzed

We collected 4,650 data points from 93 life insurance companies to measure financial stability, customer satisfaction, product and feature variety, and the overall buying experience. We then evaluated each company based on 50 metrics to develop unbiased, comprehensive reviews.

Choose kindness.

You never know what battles people may be fighting.

How Much Coverage Is The 995 Plan?

First, we’ll look at the key question most people want answered: “How much coverage is the $9.95 plan?”

You know the premium rate ($9.95), and this cost is small enough to fit any consumer budget, but what cash payout will you get?

What Is The 995 Plan From Colonial Penn?

Colonial Penn’s TV commercials are pretty slick. Whether they feature Alex Trebek or their newest spokesperson, Jonathan Lawson, pitching guaranteed life insurance starting at $9.95 per month, it’s hard not to find them compelling.

But is there substance behind their appealing marketing? That’s where we can help.

The “$9.95 Plan” (or “995 Plan”) is a whole life insurance product from Colonial Penn.

The plan offers lifetime coverage, guaranteed acceptance, and a quick online application. However, it has major drawbacks, including a 2-year waiting period and BBB complaints about claims and payout difficulties. Worst of all, it’s a ripoff.

Policies like this are often referred to as “burial insurance”, “funeral insurance”, or “final-expense insurance”, but they all refer to the same thing: whole life insurance.

995 Plan Eligibility & Coverage Period

Any U.S. resident ages 50-85 is eligible to buy a policy (50-75 years old in New York).

Like any life insurance policy, this Plan pays out a cash benefit upon death. As its name suggests, whole life insurance covers your entire lifetime (as long as you keep paying your premiums).

Your benefits will never terminate, no matter how old you are.

| Attribute | Details |

|---|---|

| Founded | 1968 |

| Address | 399 Market Street Philadelphia, PA 19106 |

| N/A | |

| Phone | (800) 523-9100 |

| Website | https://colonialpenn.com |

| BBB Rating | A+ |

| A.M. Best Rating | A- (Excellent) |

Guaranteed Acceptance Life Insurance (No Underwriting)

One of the key pros of this product is its “guaranteed acceptance” feature.

This means that you can skip the life insurance underwriting process entirely. There are no health questions, no medical exam, and no checks of your prescription drug history.

No matter what, you cannot be denied coverage for health-related reasons. This is true even if you have a complicated medical history, chronic illness, or pre-existing conditions.

Two-Year Waiting Period

While this sounds attractive, the truth is it comes with a catch.

The fine print clearly states that this life insurance plan includes a two-year waiting period.

In other words, if you die during the first two years, your policy will NOT pay out your entire death benefit.

In this case, Colonial Penn will simply return the premiums you have paid (plus 7% interest) to your beneficiary. You won’t lose money, but your whole life insurance policy will no longer serve its purpose.

This is one of the major cons of Colonial Penn’s $9.95 plan.

Note: The waiting period does not apply to accidental deaths.

If you die, for example, from a fall or car accident, your final expense life insurance policy will pay out your full death benefit.

What Is A Unit Of Life Insurance Coverage?

How does Colonial Penn work for everyone at the same rate? They offer different amounts of coverage to each person for $9.95.

Most other life insurance companies let you choose the amount of coverage you want. Then, you’ll get a quote for that ColonialPenn coverage amount.

Colonial Penn does it in reverse. You choose your price. And then they tell you how much life insurance coverage you can buy for that price.

How do they refer to what they sell for $9.95? Well, they can’t say they sell $1,000 or $2,000 of coverage because the rate would be different for every person. So, instead, they call this a “unit” of coverage. But exactly what is a unit of life insurance?

A unit of life insurance coverage = the amount of coverage a specific person can buy for $9.95.

So How Much Coverage Will They Offer Me…?

Let’s return to the original question: how much coverage do you get with Colonial Penn??

The answer is that it depends on your age and gender.

Men and women ages 50-85 are eligible to purchase the 9.95 plan from Colonial Penn.

The table below answers the question, “How much coverage is the $9.95 plan?” (For a more detailed look at Colonial Penn’s pricing, be sure to check out our article on Colonial Penn life insurance rates by age).

Table: The Coverage You Get For $9.95

| Age | Coverage For $9.95 (Men) | Coverage For $9.95 (Women) |

|---|---|---|

| Age 50 | $1,669 | $2,000 |

| Age 55 | $1,420 | $1,759 |

| Age 60 | $1,167 | $1,515 |

| Age 65 | $896 | $1,258 |

| Age 70 | $689 | $1,000 |

| Age 75 | $549 | $762 |

| Age 80 | $426 | $608 |

| Age 85 | $418 | $468 |

As you can see, the life insurance benefit amount you can purchase varies widely, depending on your age and gender.

The cost ranges from as much as $2,000 for a 50-year-old woman to as little as $418 for an 85-year-old man.

Buying Multiple Units Of Coverage

As you can see, one “unit” does NOT provide much coverage. So what if you need more coverage?

Colonial Penn allows you to purchase up to 15 units of coverage, with each unit costing $9.95.

This is how Colonial Penn can get expensive: You have to buy many units to get reasonably covered.

You can purchase two coverage units if you can afford twice that amount ($20). You can purchase three coverage units if you can afford three times that amount ($30). And so on, up to ~$150 per month for 15 coverage units.

Choose kindness.

You never know what battles people may be fighting.

Colonial Penn 995 Plan vs. Competing Life Insurance For Seniors

Plans like Colonial Penn’s $9.95 plan are informally referred to as “burial insurance” (also called “funeral insurance” or “final expense insurance”). Let’s look at why this is the case.

Overview

Below is a comparison of burial insurance life plans from Colonial Penn and its three major competitors: AARP, Globe Life, and Mutual of Omaha.

| $9.95 Plan | Mutual of Omaha |

Globe Life |

AARP | |

|---|---|---|---|---|

| Ages | 50-85 | 45-85 | 18-80 | 50-80 |

| Coverage | Varies | $2K- $40K |

$5K- $100K |

$5K- $25K |

| Medical Exam | No | No | No | No |

| Waiting Period | Yes | No | No | Yes |

| Rates $5K (65, F) | $40 | $22 | $30 | $25 |

The takeaway? You can buy just as much coverage from Mutual of Omaha for ~half the price of the 9.95 insurance plan!

Colonial Penn 995 Plan Ratings & Reviews

Enough from us, right? Let’s dive into some third-party opinions on Colonial Penn.

Financial Strength Ratings

Colonial Penn has strong financial strength ratings. This means it has the resources to pay out life insurance claims regardless of the economic environment.

Colonial Life Insurance currently holds the following ratings:

- A.M. Best: A-

- S&P: A-

- Moody’s: A3

- Fitch: A-

Colonial Penn 995 Plan Better Business Bureau (BBB) Reviews

However, the Company’s Better Business Bureau page paints a much different picture of Colonial Penn.

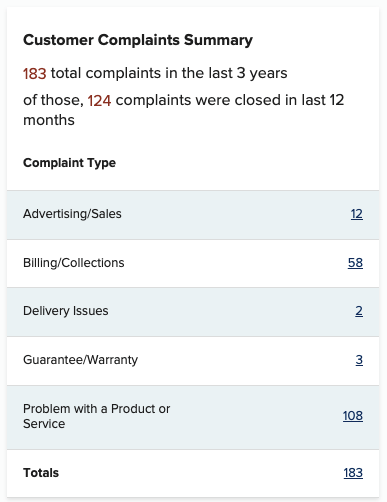

Over the past three years, Colonial Penn has had 183 customer complaints filed with the BBB, with 124 closed in the last 12 months.

An equally revealing part of their BBB profile is the customer complaints section. (See the linked article for a more detailed overview of Colonial Penn’s complaint and negative review history.)

Colonial Penn 995 Plan Frequently Asked Questions

Does the Colonial Penn 995 Plan Have A Waiting Period?

Yes, Colonial Penn’s life insurance policies has a two-year waiting period. If the insured dies of a non-accidental cause within the first two years, Colonial Penn’s death benefit will be to pay back your premiums (with 7% interest). Without this waiting period, they would not be able to guarantee approval.

How Much Coverage Is The Colonial Penn 995 Plan?

With the 995 Plan from Colonial Penn, you will get between $418 and $2,000, depending on your age and gender. 50-year-old females get the highest amount ($2,000), as they are the lowest risk, while 85-year-old men get the lowest amount ($418). When purchasing life insurance, we highly recommend checking your price on our quoter for a more affordable life insurance policy.

How Much Is A Unit Of The Colonial Penn 995 Plan?

A unit of Colonial Penn life insurance costs $9.95 monthly per unit. The size of the death benefit payout you get for one unit depends on your age and gender.

Younger females, typically in better health and with longer life expectancies, can expect to get as much as $2,000 for that price. Older males, on the other hand, may get as little as $400 for that same 9.95 price.

Choose kindness.

You never know what battles people may be fighting.

Conclusion & Key Takeaways

Colonial Penn is a well-known insurance company with a smooth application process and a strong history of paying out on claims.

However, remember that their $9.95 whole life insurance offer is a gimmick. The price is low simply because they give you such little coverage in return ($500 – $1,500)!

Is Colonial Penn’s $9.95 Per Month Whole Life Insurance Worth It For You?

Colonial Pennl has a legitimate competitive advantage in one area: the size of its policies. While most burial insurance companies start coverage at $2,000, Colonial also sells policies in the $500 to $2,000 range.

Colonial Penn’s burial insurance product may be suitable if you intend to have a direct cremation (roughly $1,500).

While these policies will still be expensive per dollar, you will likely save money by not paying for coverage you do not need.

However, those who want a traditional burial and funeral service (or a cremation with a memorial service) will need a larger payout. Why?

While there are ways to reduce the funeral service’s extravagance, you cannot buy half a casket or half a headstone. In other words, these final arrangements require a minimum expenditure of approximately $5,000.

The Colonial Penn 995 Plan is not the most affordable option for policies of this size. You can likely save 40%-60% by going with a traditional insurance company, such as Aetna, Transamerica, or Mutual of Omaha.

If you’re still unsure, check out our summary of the benefits and drawbacks of Colonial Penn.

Finally, if you have any questions we haven’t answered, don’t hesitate to comment or email us.

Warm Regards,

The GetSure Team

Article Sources

- Better Business Bureau. Colonial Penn Life Insurance Company

- TrustPilot. Colonial Penn Reviews

- Colonial Penn. 995 Plan Quotes Form