Mutual of Omaha

- "Blue chip" life insurance carrier with an A+ rating from A.M. Best

- Offers no medical exam whole and term life insurance policies

- Whole life prices are near industry lows

- Term life insurance product has a 100% "return of premium" option

- Tight underwriting makes their products unavailable to many

- Two e-signatures required; no option for voice or text signature

- 93 Companies reviewed

- 50 Features considered

- 4,650 Data points analyzed

We collected 4,650 data points from 93 life insurance companies to measure financial stability, customer satisfaction, product and feature variety, and the overall buying experience. We then evaluated each company based on 50 metrics to develop unbiased, comprehensive reviews.

Founded in 1909 in Omaha, Nebraska, Mutual of Omaha was a pioneer in the insurance industry. Today, the company continues to offer insurance and financial products for individuals and businesses.

This review will focus on two products within Mutual of Omaha’s life insurance portfolio – their Living Promise Whole Life Insurance policy and their Term Life Express policy.

| Features | Living Promise | Term Life Express |

|---|---|---|

| Ages | 45-85 | 18-70 |

| Coverage Amounts | $2,000-$50,000 | $25,000-$300,000 |

| Coverage Length | Lifelong | 10, 15, 20, 30 |

| Waiting Period | No (Level Plan) | No |

| Rates | Never Increase | Never Increase |

| Medical Exam | No | No |

Choose kindness.

You never know what battles people may be fighting.

Mutual of Omaha Living Promise Whole Life Insurance

As you age, it’s common to start thinking about what will happen when you die. Do you want to be buried or cremated? How much does it cost, and how will your loved ones pay?

The National Funeral Directors Association reports that the average funeral cost is $7,848.

Living Promise Whole Life Insurance from Mutual of Omaha can cover those expenses so your loved ones won’t have to dip into their finances.

State & Age Eligibility

Living Promise Whole Life insurance is available to residents of all states except New York.

To be eligible for this simplified issue whole life plans, you must be between the ages of 45 and 85.

Coverage Amounts

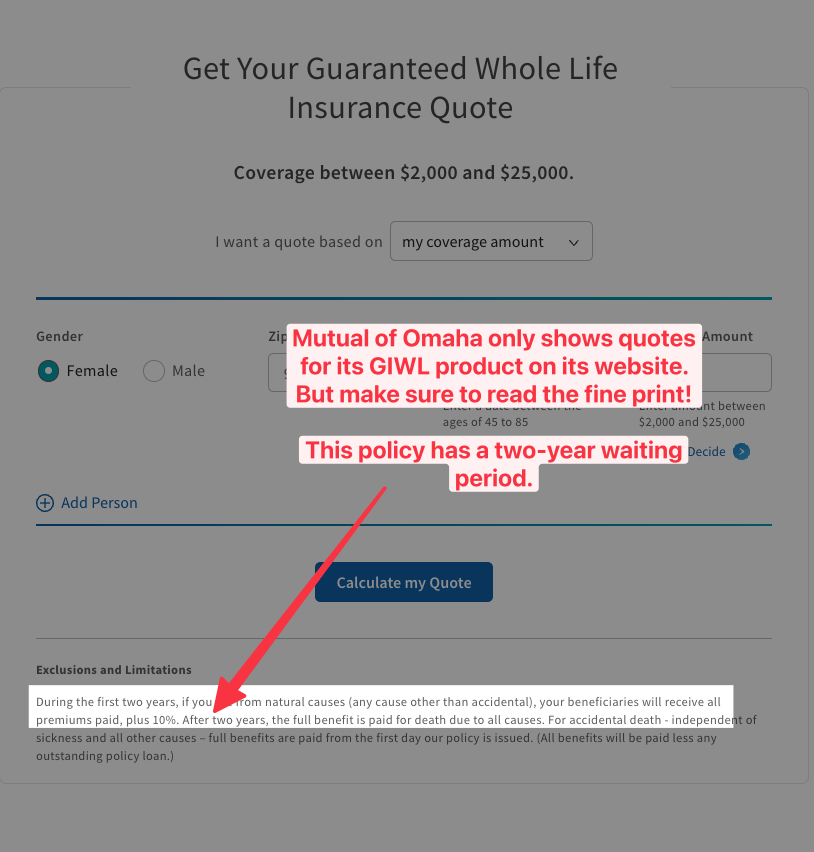

The Living Promise program offers two plans – one with a level benefit and one with a graded benefit.

You can choose between $2,000 and $50,000 on the Level Benefit Plan, which will help pay for final expenses and possibly a bit more to pay other debts.

With the Graded Benefit Plan, you can choose from $2,000 to $20,000. This plan is different as it pays back the premiums you paid into the policy plus 10% if you die within the first two years (but doesn’t pay the death benefit amount).

Death Benefit

Unemployment benefits. Disability benefits. Retirement benefits.

We immediately know what they are. They’re just money. Money you get to collect when you really need it.

A death benefit is no different, except that it’s the people you love the most who get to collect it.

So it’s no surprise that people care a lot about how much money will be available for their loved ones and when.

Mutual of Omaha’s Living Promise Whole Life coverage comes in two varieties: Level Benefit and Graded Benefit.

Level Benefit Life Insurance Plan

The Level Benefit plan (level as in “flat”) is as simple as it gets. Your policy pays out in full starting Day 1 and this never changes.

In other words, if you purchase a $50,000 policy that’s issued at noon on a Friday, and you pass at 12:01pm? Mutual of Omaha will send your beneficiary a tax-free check for $50,000.

Graded Benefit Life Insurance Policy

Living Promise also has a Graded plan (think grades as in “steps”). Whereas a level benefit policy would pay 100% of the face amount no matter when you die, a graded plan pays a smaller amount at the outset and then steps up to the full 100%.

Specifically, if you have a Graded policy with Mutual of Omaha, your policy will NOT pay out the full death benefit if you die of natural causes during the first two years. Instead, it will simply refund your beneficiary the total premiums you had paid to date (plus 10% interest).

Note that Graded policies always pay out 100% if your cause of death is accidental.

Cash Value

Cash value is just a fancy word for savings. Just as you have savings in a savings account, you have “cash value” in a whole life insurance policy.

Every time you make a premium payment, your insurer takes a portion of it and puts it into an account, allowing it to earn interest over the policy’s life. You might consider it a built-in savings account tacked onto the policy. If you die, your policy will pay out your death benefit (less any loans you have taken out against your cash value).

Living Promise Whole Life Riders

Riders, which amend the coverage, may be included in the policy or may be offered for purchase for an additional premium.

Living benefits means you can tap into the face amount under certain circumstances while you are alive, such as if you have a terminal illness, chronic illness, or need to live in a nursing home.

The Living Promise Whole Life policy includes one rider at no charge: an “Accelerated Death Benefit Rider for Terminal Illness or Nursing Home Confinement.”

This ‘living benefit” allows you to request up to 95% of your policy’s death benefit while living if you get diagnosed with a terminal illness or must be confined to a nursing home.

You can also add an accidental death benefit rider for an additional premium. This rider doubles your death benefit if you die due to an accident.

Check out: Is Sons of Norway Life Insurance Worth It?

Mutual of Omaha Term Life Express

Perhaps at this juncture in life, you’re worried about leaving your loved ones with a large debt like a mortgage, student loan, or car loan, yet you don’t have a lot of room in the budget for a life insurance payment. A Term Life Express policy will cover those expenses so you won’t leave your loved ones in a bind if you die.

State & Age Eligibility

Term Life Express policies are available in all states.

However, whereas many final expense policies, like Living Promise from Mutual of Omaha, are available even to those in their 80s, Term Life Express does not welcome octogenarians.

It’s available to American adults ages 18-75, with the length of the “term” available depending on the insured’s age at purchase.

Coverage Amounts

Dozens of burial insurance policies, especially those catering to seniors over 70 or over 80, offer a maximum of $25,000 of death benefit protection.

On the other hand, Mutual of Omaha’s simplified issue term life insurance product (“Term Life Express”) won’t let you buy less than $25,000 of coverage. The maximum face amount available depends on your age:

- Ages 18-50: Up to $300,000

- Ages 51-60: Up to $250,000

- Ages 61-70: Up to $150,000

Term Lengths

When you buy whole life insurance, you’re concerned about when full coverage begins. You already know it never ends (as long as you make your monthly payments), so you try to maximize your coverage by getting a policy that starts the soonest (with no waiting period).

Term policies, on the other hand, always pay the full face amount from Day 1. To keep your family out of harm’s way, you have to manage when your coverage will end – i.e., which company is going to cover your family the longest?

Naturally, this depends on your age at purchase. For Mutual of Omaha’s Term Life Express product, if you are:

- 18-50 years old, you can buy 10 years of protection, 15, 20, or even 30 years’ worth

- 51-60 years old, you can buy at most 20 years of term protection

- 61-70 years old, you can buy 10, or at most, 15 years of coverage

In general, you want to make sure your policy lasts longer than your expenses.

If you have two teenagers and want to safeguard their college dreams, a 10-year policy would guarantee that there will always be money for their tuition.

If you had just taken out a 30-year mortgage, you would want at least 30 years of coverage to ensure that you or your payout would always be there to make your monthly mortgage payments.

Term Life Express Riders

Of the 19 life insurance carriers we partner with, and across the 3-5 policies each of them sells, no policy has more riders than Mutual of Omaha’s Term Life Express offering.

No-Cost Riders

Here’s what they offer (for no additional cost):

- Early payout if you’re terminally ill (less than 24 months to live)

- Early payout if you have a chronic illness

- Early payout for critical illness

- Six months of premiums waived if your home is badly damaged

- Six months of premiums waived if you become unemployed

- Double the payout if you die while on a plane, train, or bus

Optional Riders

Here’s what they offer for a slight increase in your payment:

- Payments if you become disabled and cannot work

- No premiums if you become disabled until you can work again

- Additional payment if you die because of an accident

- A death benefit for a child or other dependent who dies

- A death benefit for another person (spouse, partner, etc.)

- Return of premiums you paid into the policy (only available on the 30-year term)

Conversion Option

Initially, you may decide that a term policy suits you well and later that a whole life insurance policy best meets your needs.

You can convert the Term Life Express policy to a whole life policy after the second year without having to answer medical questions.

Check Out: Whole Life Insurance from Liberty Bankers

Choose kindness.

You never know what battles people may be fighting.

Mutual of Omaha Application Process

Mutual of Omaha has a simplified application process with few steps. The company often approves policies on the same day, and you will receive your policy shortly thereafter.

All you have to do is fill out the application and answer some basic medical questions.

How Mutual of Omaha Will Decide on Your Approval

Mutual of Omaha will decide your approval based on the following criteria

- Your answers to the medical questions

- A check of your prescription drug history

Once the results are in, they’ll let you know which policies and face amounts you qualify for.

Paying Your Premiums

Your first payment is due within 30 days. You can set it up so that it’s due on the 2nd, 3rd, or 4th Wednesday to coincide with your Social Security income.

Mutual of Omaha offers various payment plans to suit your needs. You can pay annually, semi-annually, quarterly, or monthly.

Mutual of Omaha Life Insurance Pros and Cons

The benefits of Living Promise Whole Life and Term Life Express outweigh the negatives. We’ve compiled a list of pros and cons for both products so you can decide which is best for your situation.

Mutual of Omaha Living Promise Whole Life Pros

- The only carrier to offer $50,000 of no-exam coverage to ages 81-85

- Lasts for your entire life

- Built-in savings account (cash value)

- Can take loans against cash value with no credit check

- Fast approvals (typically same-day or next-day)

- Simplified underwriting = health questions and prescription drug checks instead of medical exam

- Level Benefit Plan offers full coverage Day 1

- Accelerated Death Benefit Rider allows you to request up to 95% of payout while living

Mutual of Omaha Living Promise Cons

- Overpriced accidental death benefit rider

- Provides much less coverage per dollar than term life insurance

- One of the few carriers to not offer a Child Rider for purchase

Mutual of Omaha Term Life Express Pros

- Lower premiums compared to whole life policies

- Policies are often approved same day and issued the next day

- Lets you request an early payout if you are diagnosed with a terminal illness, critical illness, or chronic illness

- Offers optional riders, including a child rider (payment when a child dies) and another person rider (to cover a second person on the same policy)

- Includes a rider that waives your premiums for 6 months if you become unemployed or have house damage

- Doubles your death benefit if you die due to an accident on a plane, train, bus, or other common carrier

- Simplified application and underwriting process

- Offers the option to convert your policy to a whole life policy (anytime before age 70)

Mutual of Omaha Term Life Express Cons

- The policy ends at the end of the specified term

- The policy does not accrue cash value

- Premiums are higher when renewing as they are based on your current age

Mutual of Omaha Ratings & Customer Reviews

You’ll want to know that your life insurance company will be there when needed. Industry ratings and customer reviews will tell you a lot about a company’s track record to affirm that you’re making a good decision.

BBB customer reviews are largely negative and mostly concern customer service and declinations. That said, considering the company’s size and the large number of applications it receives, there are few reviews.

What Does the BBB Say About Mutual of Omaha?

The BBB gives Mutual of Omaha an A+ rating for its financial strength, which is the highest rating possible. Mutual of Omaha also gets high marks for longevity in the industry, low complaint volume, and swiftness in handling complaints.

Financial Strength Ratings

Mutual of Omaha is a Fortune 500 company (ranked 300th) and one of the largest corporations in the U.S. by revenue.

So Mutual of Omaha is objectively big, and, as it turns out, unanimously strong. Their financial strength ratings from the industry’s three biggest ratings agencies are as follows:

- AM Best: A+ ( Superior)

- S&P: A1 (Good)

- Moody’s: A+ (Strong)

Choose kindness.

You never know what battles people may be fighting.

FAQs About Mutual of Omaha Whole Life Insurance

What is Living Promise with Mutual of Omaha?

Living Promise is a simplified-issue whole life insurance product that provides a death benefit and cash value. It’s a good product for burial coverage or final expense insurance.

Does Mutual of Omaha offer burial insurance?

Yes. Their burial insurance product is sold under the brand name “Living Promise”. It’s also referred to as funeral insurance, final expense insurance, or simplified issue whole life insurance.

What is Term Life Express with Mutual of Omaha?

Term Life Express is a simplified term life policy that lasts for your chosen term (10, 15, 20, or 30 years). It’s best suited for someone with large (but temporary) expenses, such as repaying a mortgage or funding a child’s college education.

Does Term Life Express Have Living Benefits?

Yes. The Term Life Express policy offers several living benefits, including payments for terminal, chronic, or critical illnesses. It also waives your premiums if your home sustains major damage or you become unemployed.

Conclusion

When shopping for life insurance, let your purpose be your guide. What circumstances would your loved ones have to face if you die? The loss of your presence would be difficult enough, and the right life insurance policy would ease their financial burden when needed.

You might consider whole life insurance as a policy to cover permanent or long-term expenses like taking care of your final expenses to avoid burdening your family.

On the other hand, if temporary expenses are you might think of term life as a way to cover temporary expenses such as paying for student loans or your mortgage.

Mutual of Omaha is a financially strong life insurance company with a longstanding history in the business, similar to Guarantee Trust Life insurance, and they have life insurance products for every need.

Article Sources

- National Funeral Directors Association. 2021 NFDA General Price List Study Shows Funeral Costs Not Rising as Fast as Rate of Inflation

- Better Business Bureau. Mutual of Omaha Companies

- Mutual of Omaha. Final Expense Estimator

- Mutual of Omaha. Whole Life Insurance

- Bureau of Labor Statistics. The Rising Cost of Dying