- 93 Companies reviewed

- 50 Features considered

- 4,650 Data points analyzed

We collected 4,650 data points from 93 life insurance companies to measure financial stability, customer satisfaction, product and feature variety, and the overall buying experience. We then evaluated each company based on 50 metrics to develop unbiased, comprehensive reviews.

Choose kindness.

You never know what battles people may be fighting.

Who Is AAA Life Insurance Company?

Headquartered in Livonia, Michigan, AAA Life Insurance is a subsidiary of the well-known AAA (or “Triple A”) organization.

It is licensed to sell life insurance and annuities in all states except New York and has a base of 1.3 million policyholders.

AAA Life has an A+ rating from the Better Business Bureau (BBB) and a financial strength rating of A (Excellent) from A.M. Best.

| Attribute | Details |

|---|---|

| Founded | |

| Address | 17900 N. Laurel Park Dr. Livonia, MI 48152 |

| [email protected] | |

| Phone | ( |

| Website | https://www.aaalife.com |

| BBB Rating | A+ |

| A.M. Best Rating | A (Excellent) |

AAA Life vs. Competitors

Key competitors for the AAA burial insurance product include Colonial Penn’s $9.95 plan and Mutual of Omaha’s Living Promise whole life insurance offering, among many others.

Check out: Lincoln Heritage Life Insurance Products Overview

AAA Life Insurance Offerings

AAA offers both major types of life insurance coverage:

- Term life insurance

- Permanent life insurance (i.e., whole life insurance)

The Company offers multiple products within each category, catering to different customer preferences (e.g., high face value amounts, no medical exam coverage, among others).

AAA’s life insurance rates are competitive across all life insurance policies, whether you buy term or permanent coverage. As long as you pay premiums on time, your death benefit will also be paid on time.

Unlike burial insurance from AARP, which limits its product to AARP members, AAA Life does not require a Triple-A membership to purchase its policies.

(AAA members receive a 10% discount on premiums paid, so you may find it worth joining!)

Finally, note that AAA Life does sell more complex permanent policies, such as universal life insurance, as well as other financial products (e.g., annuities), but we will not be covering those in this review.

Check Out: Gerber Life Insurance Products Reviewed

Choose kindness.

You never know what battles people may be fighting.

AAA Burial Insurance Policies

AAA offers two types of burial insurance coverage (final expense insurance or funeral insurance): a traditional whole life policy and a guaranteed acceptance offering.

Whole life policies cover the insured for their entire lifetime (their “whole life”). No matter how long the insured lives, AAA will pay your beneficiary the death benefit payout.

Note that this differs from term life insurance, in which coverage ends after a set period (called the “term”).

Finally, a big draw of burial insurance policies is that no medical exam is required. The insurer may still factor your health into its underwriting, but if so, they will do it based on health questions, not a physical exam.

Is Burial Insurance The Same As Life Insurance?

This is one of the most common questions we are asked.

Burial insurance is just a nickname for whole life insurance policies with low coverage amounts (typically under $25,000).

A burial insurance policy typically has a death benefit between $2,000 and $25,000 (up to a maximum of $50,000). The policy’s death benefit is sized to cover final expenses, such as funeral costs, unpaid medical bills, and other expenses.

The Need For Burial Insurance

The sharp rise in burial insurance sales over the past two decades is due to an equally sharp rise in funeral costs.

Rising Funeral Costs

According to the National Funeral Directors Association (NFDA), the average funeral cost in the U.S. now exceeds $10,000. The includes expenses such as the casket price, the headstone cost, and funeral home service fees, among many others.

This has put the traditional funeral and burial out of reach for most Americans.

Indeed, the rise in funeral and burial costs is the main reason the national cremation rate increased from 32% in 2005 to 56% in 2020, according to the NFDA.

That’s a shockingly large number of Americans being cremated instead of buried!

Seeking An Immediate Solution

There is nothing wrong with cremation. We encourage you to see our article on the pros and cons of burial and cremation if you are undecided.2

However, many Americans prefer a traditional funeral service and burial. Whether for religious reasons, family traditions, or emotional closure, among many other reasons, the way we lay our loved ones to rest means a lot to us.

This is precisely why burial insurance purchases have skyrocketed over the past decade. People are becoming aware of how much a traditional funeral costs and are seeking a financial solution to provide them with the funds immediately, even if the insured drops dead a minute after purchasing his life insurance policy!

AAA Guaranteed Issue Whole Life Insurance

The first of AAA’s whole life insurance policies is its guaranteed acceptance policy, as shown below.

Importantly, you do not have to take a physical exam or answer health questions to be approved (even if you have a terminal illness). Moreover:

- This policy builds cash value (and can therefore act as a savings account)

- AAA life insurance policies have fixed premiums, so your premium payments will never increase after your coverage begins

While the former is common to all whole life policies, that is NOT the case for the latter. For policies from burial insurance companies like Globe Life or Mutual of Omaha, your premiums increase every five years as you enter a new age bracket.

Note that this policy does have a “waiting period.” If the insured dies during the first two years, AAA will return your premiums paid, plus interest. However, you will not get the full death benefit paid.

AAA Whole Life Insurance

The second of AAA’s two whole life insurance policies requires more effort during the application process, but the upside is higher coverage limits, lower life insurance rates, AND no graded death benefit during the first two years.

Unlike their guaranteed issue whole life insurance policy above, with this policy, you will have to answer medical questions, and for policies over $30,000, an exam will likely be required.

However, both policies accumulate cash value and do not require an AAA membership to purchase. As mentioned above, AAA members’ premium payments will be discounted by 10%.

AAA Term Life Insurance Policies

Term life is the most straightforward form of life insurance coverage.

Policyholders are covered for a set period. If you die during the term, the insurance company pays your beneficiary a death benefit payout. If you live longer than the policy’s term, your coverage expires. (If you’re wondering about the cost of a $1 million term policy, check out our linked guide.)

AAA Life offers two term life products, “ExpressTerm” and “Traditional Term.”

Eligibility Criteria

To be eligible for either product, you must satisfy two eligibility criteria:

- Age: 18-75 years old

- Residence: Any U.S. state, except for New York

While some insurers do not accept convicted felons as applicants, AAA Life has no restrictions.

You do not have to be a member of “Triple A” (the auto-related organization) to purchase AAA life insurance!

AAA ExpressTerm Life Insurance

The first of these products is called ExpressTerm, and like recent start-ups Haven Life and Ladder, the entire purchase process, from quote to application to policy issuance, is 100% online.

(So you can complete the process without speaking to an agent).

Coverage amounts range from $25K to $500K, and term lengths come in 10, 15, 20, and 30-year options.

Since bypassing the health exam is possible, those who qualify can finish the entire process in 10-15 minutes and potentially receive an instant decision.

Getting $500K of near-instant coverage with no health exam would be a dream purchase experience. So if you’re young and healthy, this will be an enticing option.

AAA Traditional Term Life Insurance

The second term product on offer is a fully underwritten policy.

With these policies, applicants must provide more information, including going through a medical exam, but the upside is that prices are generally lower.

Another key difference is that the traditional term policy offers several riders, as listed below. (Riders are “add-on” features to insurance policies that provide optional benefits for an additional cost.)

- Child Term: Allows you to add $20,000 of life insurance on each of your children

- Disability Waiver of Premium: Waives your premium obligations if you become disabled

- Return of Premium: Gives you back all of your payments if you live to the end of your term

How To Get A Price Quote From AAA Life

If you want a life insurance policy from AAA, the first step in the application process is to request a quote.

The estimate you see for your monthly premium rate won’t be fixed in stone, but it should give you a sense of the coverage amount you can afford.

1. Navigate To The Relevant Product Page

First, choose the product you believe best matches your needs. Then, navigate to your chosen product’s page on the AAA Life website.

(You can change this later to explore insurance quotes for a different product.)

2. Complete the Quote Form

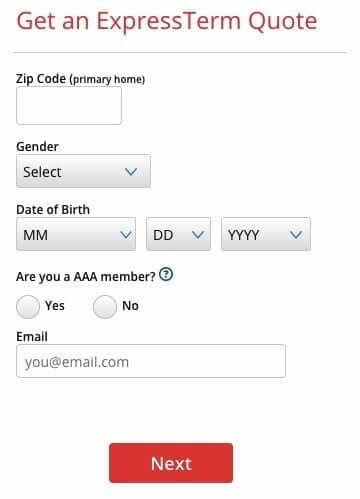

You should see a quote form at the top of your page that looks very similar to the first image below.

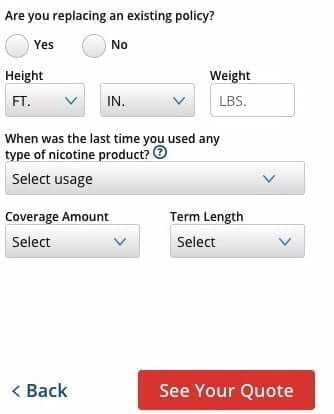

Fill out the requested information on both pages. (Feel free to use a fake email address if you prefer not to share your contact information. You’ll be shown your quote regardless of what you enter into the email field.

Unlike many of its peers, who either have lengthy quote forms or email you a quote at some later point, AAA gives you an instant quote after the two simple pages below.

(You can see exactly what information AAA Life requests of you in the two screenshots below.)

AAA Life Insurance Quote Form (Page 1)

AAA Life Insurance Quote Form (Page 2)

3. Use The “Quote Calculator” To Find The Best Death Benefit Amount For You

You should see your estimated monthly premium rate on a page like the image below.

This page shows your quoted monthly premium rate. Even better:

AAA allows you to easily see your premium rate for different term length and coverage combinations.

To change the term length, click on one of the four options at the bottom (10, 15, 20, or 30 years). To adjust the coverage amount, use the slider.

Choose kindness.

You never know what battles people may be fighting.

AAA Burial Insurance FAQs

What types of life insurance does AAA Life offer?

AAA Life sells both term and whole life insurance, in a similar approach to how GTL’s simplified issue policies are structured. AAA sells a “simplified issue” policy for those who want an instant decision and a traditional, fully-underwritten policy for term insurance. AAA has sold guaranteed and simplified issue policies for its whole life.

Is AAA Life a reputable company?

AAA Life’s reputation is a mixed bag. On the one hand, it is a subsidiary of Triple-A, one of the most trusted organizations in America. On the other hand, it’s difficult to find customer reviews. While the Company has an A+ rating from the Better Business Bureau, all six reviews on their site give AAA 1 star (out of 5).

Can I add more than one beneficiary to my AAA policy?

Yes, you can add as many beneficiaries as you want at any point during your policy’s term. The only condition is that the beneficiary percentages must total 100% for primary and contingent beneficiaries.

Can I cancel my AAA life insurance policy?

Yes, you can cancel your policy at any time. However, as with other policy modifications (e.g., name changes, beneficiary additions, etc.), you can only do this by written request.

Conclusion

We hope you found this review of AAA’s life insurance offerings helpful. If you have any additional questions, don’t hesitate to leave a comment or send us an email. We’ll be sure to get back to you within 24 hours.

We hope to see you back here soon!

Warm Regards,

The GetSure Team

Article Sources

- AAA Life. Traditional Term Life Insurance

- AAA Life. ExpressTerm Life Insurance

- AAA Life. Whole Life Insurance

- AAA Life. Guaranteed Issue Whole Life

- Better Business Bureau. AAA Life Insurance Company