Term life insurance is a type of life insurance that provides coverage for a specific period, typically 10, 20, or 30 years. It pays the policyholder’s beneficiaries a death benefit if they die during the policy’s term. Term life insurance is generally considered the most affordable type of life insurance. It is often used to provide financial protection for a specific period, such as the length of a mortgage or the time until children become independent.

The cost of term life insurance can vary significantly based on the policyholder’s age. As people age, their mortality risk increases, so insurance companies charge higher rates for older policyholders. This article will explore how age affects term life insurance rates so you can make informed decisions about your coverage.

Choose kindness.

You never know what battles people may be fighting.

Factors That Affect Term Life Insurance Rates

Health and lifestyle: Insurance companies consider an individual’s overall health and lifestyle when determining their term life insurance rates. Individuals in good health, who don’t smoke, and who have healthy lifestyles will typically pay lower rates than those who don’t.

Occupation and hobbies: Some occupations and hobbies are considered riskier than others. For example, individuals who work in unsafe environments or engage in high-risk hobbies like skydiving may pay higher rates.

Family medical history: Insurance companies will also examine an individual’s medical history when determining their rates. Individuals with a history of certain medical conditions in their family may pay higher rates because they are at a higher risk of developing those conditions.

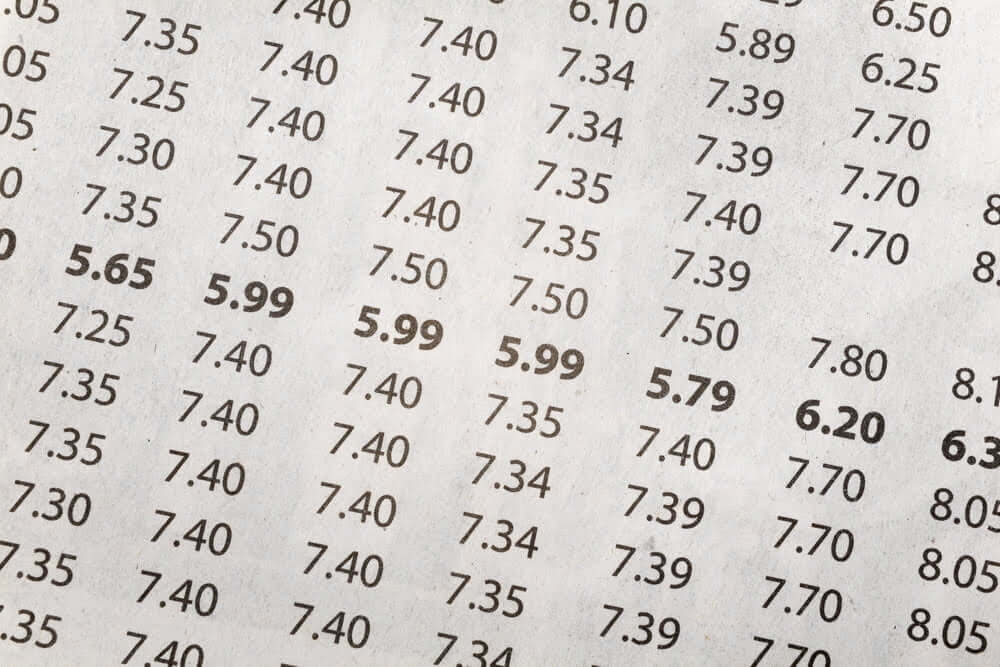

Rates for 30-Year Term Life Insurance

Male Non-Smoker

| Age | $50,000 | $100,000 | $250,000 | $500,000 | $1,000,000 |

|---|---|---|---|---|---|

| 30 | $10 | $14 | $24 | $39 | $65 |

| 40 | $15 | $21 | $33 | $59 | $118 |

| 50 | $31 | $42 | $78 | $150 | $292 |

| 60 | $145 | $282 | $694 | N/A | N/A |

Male Smoker

| Age | $50,000 | $100,000 | $250,000 | $500,000 | $1,000,000 |

|---|---|---|---|---|---|

| 30 | $19 | $29 | $58 | $103 | $209 |

| 40 | $34 | $51 | $109 | $212 | $409 |

| 50 | $74 | $114 | $263 | $469 | $1,001 |

| 60 | $254 | $500 | $1,238 | N/A | N/A |

Female Non-Smoker

| Age | $50,000 | $100,000 | $250,000 | $500,000 | $1,000,000 |

|---|---|---|---|---|---|

| 30 | $9 | $12 | $20 | $30 | $50 |

| 40 | $13 | $17 | $27 | $46 | $86 |

| 50 | $24 | $32 | $63 | $112 | $209 |

| 60 | $145 | $282 | $694 | N/A | N/A |

Female Smoker

| Age | $50,000 | $100,000 | $250,000 | $500,000 | $1,000,000 |

|---|---|---|---|---|---|

| 30 | $16 | $22 | $45 | $83 | $154 |

| 40 | $29 | $41 | $81 | $148 | $286 |

| 50 | $58 | $93 | $194 | $358 | $679 |

| 60 | $254 | $500 | $1,238 | N/A | N/A |

The tables above show the 30-year term life insurance rates by age for males and females who are either smokers or non-smokers. The rates are presented for coverage amounts of $50,000, $100,000, $250,000, $500,000, and $1,000,000.

Rates increase as the coverage amount increases. Additionally, rates increase as the insured’s age increases. Furthermore, life insurance rates for cigar smokers are higher than non-smokers for the same coverage amount and age.

For example, a 30-year-old male smoker would pay $10 per month for $50,000 in coverage, while a 30-year-old male non-smoker would pay $19 monthly for the same coverage. A 50-year-old male smoker would pay $31 per month for $50,000 in coverage, while a 50-year-old male non-smoker would pay $74 monthly for the same coverage.

Also, rates get higher as age increases for smokers versus non-smokers. For example, a 30-year-old male smoker would pay $10 per month for $50,000 in coverage, while a 60-year-old male smoker would pay $145 monthly for the same coverage. The rates for a 30-year-old and 60-year-old non-smoker are $19 and $254, respectively.

Rates for females are generally lower than for males, regardless of whether they are smokers or non-smokers. This is because, statistically, females have a longer life expectancy than males so insurance companies can charge lower rates for females. The difference in rates between males and females becomes more noticeable as the coverage amount and age increase.

For example, a 40-year-old female non-smoker would pay $29 per month for $50,000 in coverage, while a 40-year-old male non-smoker would pay $34 monthly for the same coverage.

Choose kindness.

You never know what battles people may be fighting.

How Do 30-Year Term Life Rates Compare to 20- and 15-Year Term?

30-year term life insurance rates tend to be higher than 20-year and 15-year term life insurance rates. The longer the policy term, the higher the monthly rate because the insurance company will provide longer coverage.

A 20-year term policy would have lower rates than a 30-year term policy because there is a lower risk for the insurance company to pay out the death benefit in a shorter term. Similarly, a 15-year term policy would have lower rates than a 20-year term policy because the payout risk is even lower.

While 30-year life insurance rates may be higher, they can still be more affordable than permanent life insurance options like whole life insurance.

Who Typically Buys a 30-Year Term Life Policy?

30-year term life insurance policies are typically purchased by individuals who want coverage for a longer period but still want to keep the cost of their insurance low. Some common reasons people buy 30-year term life insurance include:

Financial protection for a long-term mortgage: A 30-year term policy can provide coverage for a 30-year mortgage, ensuring that if the policyholder dies, their loved ones can pay off the mortgage.

Provide financial protection for their children: Some people want to ensure that their beneficiaries will have financial protection for longer, such as until their children reach independence.

Lock-in rates while they are still young and healthy: Some people buy a 30-year term policy while they are still young and healthy so that they can lock in lower rates. As they age, they may not be able to qualify for coverage or may have to pay higher rates.

How to Compare 30-Year Term Life Insurance Rates

Compare life insurance rates: To accurately compare 30-year term life insurance rates, you should get quotes from multiple insurance companies. Each company has its underwriting rules and criteria, so rates vary significantly.

Look at the policy’s term: Make sure you’re comparing 30-year term policies and not policies with different terms.

Consider the company’s financial strength: Choose a financially stable company with a good rating from independent rating agencies like A.M. Best. This will ensure that the company can pay the death benefit if needed.

Policy’s flexibility: Some policies have more flexible options for premium payment options, coverage amount, and conversion options (conversion option allows you to convert to a whole life insurance policy during or at the end of the term period).

Read the policy’s fine print: Before making a final decision, read the policy’s fine print to ensure you understand the coverage options and exclusions.

Choose kindness.

You never know what battles people may be fighting.

Final Thoughts

30-year life insurance policies provide financial protection for your loved ones, especially if you have young children and a mortgage.

Understanding the cost of coverage at different ages is important when deciding whether a 30-year term policy is right for you.

When shopping for a 30-year term life insurance, you should consider your budget, need for coverage, age, and health. It’s always a good idea to compare quotes from multiple companies and consult an independent life insurance agent to determine the best coverage for your situation.

By taking the time to research and compare 30-year term life insurance rates by age, you can ensure that you and your loved ones are protected.