(We don’t believe in fluffy intros.)

Here are ten life insurance facts that will change how you feel about an otherwise boring industry.

Choose kindness.

You never know what battles people may be fighting.

Fact About Life Insurance Ownership

The first set of statistics looks at life insurance ownership over time in the United States and the demographic(s) where this trend is most prominent.

1. Life Insurance Ownership Is At Record Lows

Life Insurance Fact #1: Whereas 72% of Americans had life insurance coverage in 1960, ownership in the U.S. has fallen nearly every year since then, reaching a new low of 54% in 2020.

This includes Americans whose only coverage comes from a group life insurance policy (offered by some employers as an employee benefit) and individual life insurance purchased directly by policyholders purchased in the individual life insurance market.

Many factors contributed to this decline, but as we’ll get to in Facts #7 and #9, there’s good reason to believe this trend may reverse course very soon.

2. Lower And Middle-Income “Boomers” Are The Sources

Whereas Fact #1 discussed the “what” of life insurance ownership, the following two sections discuss the “where.”

I.e., which subsets of the population have seen the most significant drops in ownership?

Life Insurance Ownership By Age Group

When looked at by age, there is a clear divergence, with one end of the spectrum doing substantially worse than the other (and no, it’s not younger millennials or Gen Z).

Life Insurance Fact #2: Life insurance ownership declined the most among those over 65, falling 21% over the past decade, from 67% in 2011 to 53% in 2020.

“Burial insurance” is the predominant type of life insurance held by seniors. Burial insurance is simply whole life insurance with face values (typically between $5K and $25K) that reflect their intended use (funeral costs). This decline in senior life insurance ownership comes at a particularly inopportune time, given the sharp rise in funeral costs over the past two decades. (The average American funeral costs between $7K and $10K today.)

Americans in the 45-65 bracket saw a similar decline (19%) over the past decade.

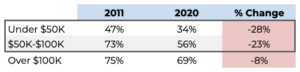

3. Life Insurance Ownership For Middle-Class Americans Is Down Sharply

The next of these life insurance statistics will be less of a surprise.

Middle- and lower-income households have fared the worst regarding life insurance ownership over the past decade.

% of Households That Own Life Insurance

Life Insurance Fact #3: Life insurance ownership among households with less than $100K of annual income decreased by ~25% between 2011 and 2020.

(Note that the $50K-$100K bracket didn’t fare much better, with its coverage rate falling from 73% in 2011 to 56% in 2020.)

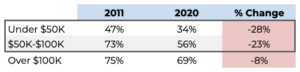

4. Consumers Overestimate Life Insurance Premiums

Pop Quiz! Can you guess the annual cost of a 30-year term life policy, with a $250K death benefit, for a non-smoking, healthy 30-year old male?

Annual Premium Estimates ($250K, 30-Year Term; Healthy 30 Y.O. Male)

(Don’t worry if you’re off by a large margin; you’ll have plenty of company.)

Life Insurance Fact #4: 70% of respondents overestimate term life insurance rates (and nearly two-thirds of these do so by 600%+!).

The actual cost is roughly $160 per year, implying a monthly premium of ~$13.

Is this ~$500-$1,000 difference preventing customers from buying a policy?

It’s difficult to know for sure, but whose purchasing decisions will be more influenced by a $500-$1,000 price difference? Those with lower household income (and a correspondingly tighter budget).

And from Facts #2 and #3, where is the bulk of the untapped market? Again, among those with lower incomes.

Judging by this back-of-the-envelope logic, the industry would be wise to invest in customer education campaigns to get basic life insurance information to customers who are most likely to see and engage with it (e.g., on mobile).

Facts About Life Insurance Purchasing

The second set of statistics looks at how consumers buy life insurance and their related preferences.

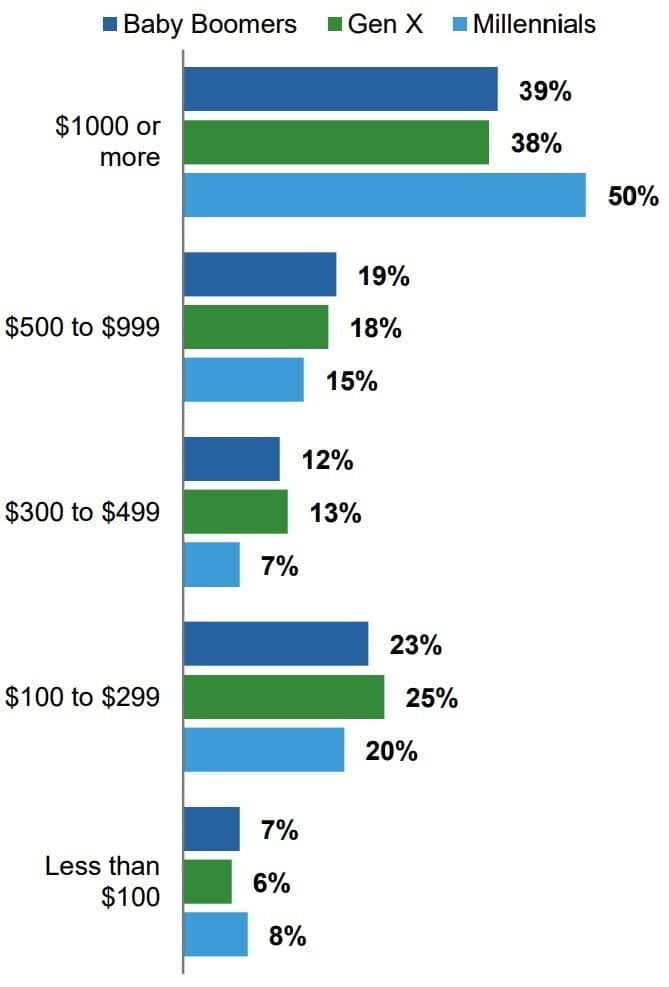

5. The Distribution Model Has Been Upended

Life insurance policies have traditionally been sold face-to-face, whether in one’s home with a door-to-door insurance agent or across a desk from one of the many independent or captive agents employed by the industry.

Even in 2011, well into the iPhone and broadband era, almost two-thirds of Americans preferred to buy life insurance in person.

But consumers changed their minds en masse in the past decade, which we believe is the most significant trend in life insurance overall.

Life Insurance Fact #5: In 2011, ~two-thirds of Americans (64%) preferred to buy life insurance in-person. Over the past decade, this has fallen sharply (to 51% in 2016 and 41% in 2020).

No surprise, nearly all of this decline has moved to a preference for online purchasing, with 37% of Americans in the 2020 survey choosing online as their preferred channel.

But here’s what will surprise you. The 2020 LIMRA survey was conducted in January 2020, before COVID-19 stay-at-home orders forced many Americans to try online purchasing for the first time.

This means that the 2021 LIMRA survey (to be published in June 2021) should show a further increase (and potentially a large one).

The Consequences Of The Move Online

One crucial knock-on effect of life insurance’s move online has been a change in the type of life insurance policy purchased, with a larger share of purchases going to term life products.

Term life insurance is a more straightforward policy than permanent life insurance, given the latter’s cash-value savings portion and varying premium structures.

The more life insurance purchasing moves online, the more consumers will likely prefer the more straightforward term product vs. permanent life insurance policies that seem risky to buy without a professional’s help.

6. The Industry’s Largest Issuers Are Not Keeping Up

Life Insurance Fact #6: Of the top three issuers of individual life insurance in the U.S. — Northwestern Mutual, Prudential Financial, and New York Life: (1) only one company (Prudential) has an online application, and (2) none of them has a mobile presence.

This poor online and mobile showing comes at a time when:

1. Consumer buying preferences are rapidly moving towards online channels (as discussed in Fact #5)

2. Mobile is becoming the dominant digital platform (51% of total time online comes from smartphones), a trend that will only increase as 5G becomes the norm

3. Mobile app engagement rates are 4x higher as compared to web viewing

7. Start-Up Life Insurance Companies Are Jumping In

Tech innovation has re-shaped several financial services verticals over the past 10-15 years. And while innovation in the life insurance industry has been slower, it’s been picking up as of late.

Companies like Ethos, Ladder, and Health IQ were the first to bring the life insurance process online. Now, a group of new start-ups, including Bestow, Fabric, and Sproutt, are re-imagining the underwriting process and removing the need for a medical exam.

The most impressive of this bunch is a start-up named Bestow. Founded in 2017, Bestow has raised $145 million from a host of prominent venture capital firms.

Like the other start-ups mentioned here, Bestow came to market as a broker, meaning it relied on a licensed carrier to issue and payout on the formal policy.

This partnership model has limited what these start-ups can do in terms of product innovation. However:

Life Insurance Fact #7: In December 2020, the first full digital life insurance company was formed when Bestow acquired Centurion Life Insurance Company, an insurer licensed in 47 states and Washington D.C.

Bestow will now have complete control over the life insurance contract structure, meaning we’ll likely see some innovative new life insurance products come to market over the next few years.

Choose kindness.

You never know what battles people may be fighting.

Facts About Life Insurance Needs

8. The “Need Gap” Points To A Large Market Opportunity

Life Insurance Fact #8: The difference between those who believe they need life insurance and those who actually have it (known as the “need gap”) was 16% in early 2020, implying a market opportunity of 41 million.

COVID has shown many families how quickly the unthinkable can happen. And these families have seen up close how valuable income replacement can be (or, conversely, how much hardship loved ones endure when a household doesn’t have enough life insurance coverage).

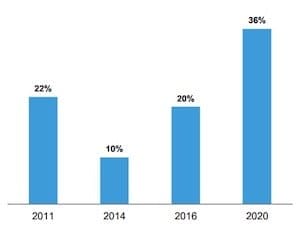

9. Near-Term Purchase Intent Is At A Decade High

Life Insurance Fact #9: In 2014, only 10% of non-owners reported a high near-term intent to purchase life insurance. In 2020, this figure has more than tripled, to 36% of non-owners.

In 2021, we expect the data to show higher perceived need overall, a larger proportion of non-owners who intend to buy in the near term, and ultimately, more reported intent materializing in actual purchases.

With luck, 2021 may even give us a reversal of the 60-year decline in U.S. life insurance ownership discussed in Fact #1.

10. Search Data Shows Increased Interest In Life Insurance

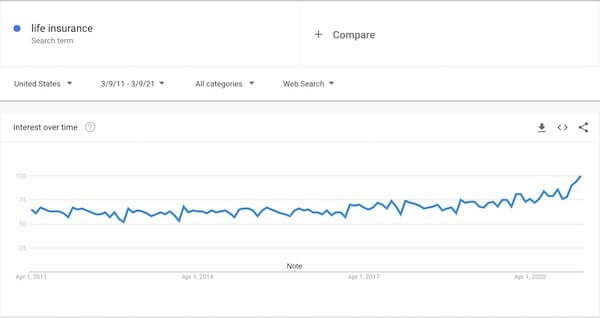

For Fact #10, we looked at data on Google search trends for the phrase “life insurance.”

Since nearly all consumers use Google to do a portion of their research, we gauged that this data would mirror the ups and downs in life insurance research done by consumers in the aggregate.

Compared to survey data, we saw this data as a good, objective gauge of intent and were curious to know if it mirrored the reported intent trends from Fact #9.

And from our limited data, at least, it wasn’t a bad proxy. As shown in the screenshot above:

Life Insurance Fact #10: Google searches for the phrase “life insurance” have almost doubled since 2016 and are at a ten-year high, mirroring LIMRA’s 2020 findings on life insurance purchase intent.

Wrapping Up

And that should do it. Ten facts about life insurance, and if we delivered on our promise, an intriguing look into the life insurance industry.

Either way, let us know how we did in the comments.

And finally, don’t hesitate to email us at [email protected] with questions, comments, or suggestions on how we can make this site even more helpful for you.

Warm Regards,

The GetSure Team