- 93 Companies reviewed

- 50 Features considered

- 4,650 Data points analyzed

We collected 4,650 data points from 93 life insurance companies to measure financial stability, customer satisfaction, product and feature variety, and the overall buying experience. We then evaluated each company based on 50 metrics to develop unbiased, comprehensive reviews.

Choose kindness.

You never know what battles people may be fighting.

Ladder Life Insurance: Need-To-Know’s

Founded in 2015 and located in Menlo Park, CA, Ladder is an online life insurance broker.

Ladder offers $100K to $8M in term life insurance coverage (without a medical exam for up to $3M — you’ll just have to answer some health questions), a 100% online application, and perhaps the best coverage flexibility for policyholders within the life insurance industry.

Who owns Ladder Life insurance? The company was founded by Jack Dubie, Jamie Hale, Laura Hale, and Jeff Merkel, with Hale acting as a CEO at the moment. Its insurance policies are issued by Allianz Life Insurance Company of New York for residents of New York, and by Allianz Life Insurance Company of North America for residents of all other states and Washington, D.C.

| Attribute | Details |

|---|---|

| Founded | 2015 |

| Address | P.O. Box 456 Menlo Park, CA 94026 |

| [email protected] | |

| Phone | (844) 533-7206 |

| Website | https://www.ladderlife.com |

| BBB Rating | N/A |

| A.M. Best Rating | A+ (Allianz Life Insurance Company of North America and Allianz Life Insurance Company of New York) |

The Ladder Life insurance phone number to reach customer support is (844) 533-7206, and their email address is [email protected]. The company can also be reached by live chat.

Is Ladder Legit?

Ladder is a highly reputable life insurance agency. The Ladder Life insurance rating on TrustPilot is of 4.8 stars, accumulated from 1,700+ unique Ladder insurance reviews, making it the highest-rated life insurance broker on TrustPilot (and placing it ahead of two key competitors, Bestow Life Insurance and Ethos Life Insurance).

Ladder has also received a large amount of funding ($194 million) from a group of prominent life insurance companies and venture capital firms, including Allianz Life Ventures, Northwestern Mutual Future Ventures, Lightspeed Venture Partners, Canaan Partners, and Nyca Partners. This positions it as a strong competitor in the market, similar to companies like Genworth Life Insurance.

Finally, the carriers who issue and pay out on Ladder’s policies have strong financial strength ratings from A.M. Best, indicating that they are a very safe bet to pay out. Allianz Life Insurance Company of New York and Allianz Life Insurance Company of North America have been rated A+ (Superior) based on an analysis of financial position and operating performance — affirmed October 2021, by A.M. Best Company, an independent analyst of the insurance industry.

Check Out: Exploring Jackson National Life Insurance Options

Check Out: Navy Federal Life Insurance Reviews

What Products Does Ladder Offer?

There is only one LadderLife life insurance type you can purchase: term life insurance. (They do not sell permanent life insurance, so any mention of LadderLife whole life insurance online is misguiding at this moment in time.)

To be eligible for Ladder’s term life insurance policies, you must be a U.S. citizen (or lawful permanent resident for 2+ years) between 20 and 60 years old.

Applicants can choose a 10-, 15-, 20-, 25-, or 30-year term and a face value between $100,000 and $8 million.

(None of the company’s online peers offer this much coverage, which is why many consider LadderLife best life insurance online. For example, life insurance coverage from Bestow maxes out at $1.5 million.)

Does Ladder Require A Medical Exam?

Unlike traditional life insurance options, some applicants will be approved without a medical exam. Ladder guarantees no medical exams, just a few health questions as part of the online application, for up to $3M in coverage.

There are a couple of upsides to Ladder’s process:

1. You’ll get an instant decision on coverage right after submitting your application (which takes less than 10 minutes).

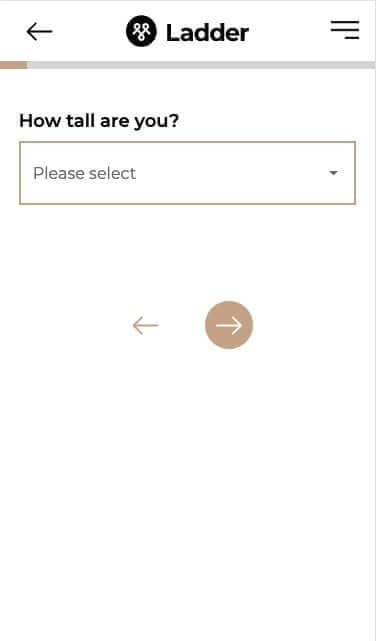

2. Second, if you’re applying for more than $3M in coverage and you have to complete a health check, Ladder’s process is painless. A traveling technician comes to you. And the appointment itself is pretty basic: they measure your height and weight, take your blood pressure and pulse, and collect a urine and blood sample.

Does Ladder Offer Riders?

Riders are features you can add to a life insurance policy to increase your coverage amount and/or flexibility. Two of the most common ones are:

- “Waiver of premium” riders, which waive your premiums if you become disabled and are unable to work

- “Accidental death benefit” riders, which provide an increased death benefit payout to the policy’s beneficiaries if the insured dies from an accident

Ladder does not offer riders; they believe that riders complicate life insurance and do not provide enough benefit for their added costs.

Check Out: Comprehensive Review of Brighthouse Life Insurance

Choose kindness.

You never know what battles people may be fighting.

What Makes Ladder Different

One of the best parts of getting coverage with Ladder is the flexibility you have to adjust your policy’s death benefit.

Ladder’s Policies Are Uniquely Flexible

People buy life insurance to help provide for future financial obligations, such as mortgage payments and college tuition expenses.

However, these needs do not stay constant. As you pay down your mortgage and your kids pass through college, your unfulfilled obligations decrease, and you likely need less life insurance coverage.

Ladder recognizes that your needs may decrease over time, so why should you continue to pay for coverage you do not need?

Unlike virtually all other life insurance providers, Ladder allows its policyholders to decrease their coverage at any time without fees or penalties. (And if your needs grow, you can apply to increase your coverage.)

Whether you want to increase or decrease your coverage (“ladder up” or “ladder down,” as the company calls it), you can do all of this online from your account dashboard.

Ladder’s Rates Are Lower Than Peers

If you’re interested in the LadderLife life insurance cost, here are some ways in which the company manages to beat out their competitors:

- Using sophisticated, algorithmic underwriting

- Using an online application and policy management platform to save on operating expenses

- Allowing its policyholders the flexibility to decrease their coverage as their financial needs change. (For example, if you “ladder down” your coverage by 50%, your premiums will also decrease by 50%)

Even without the benefit of medical exam data for many applicants, LadderLife life insurance rates are rather competitive.

Ladder: The Purchase Process

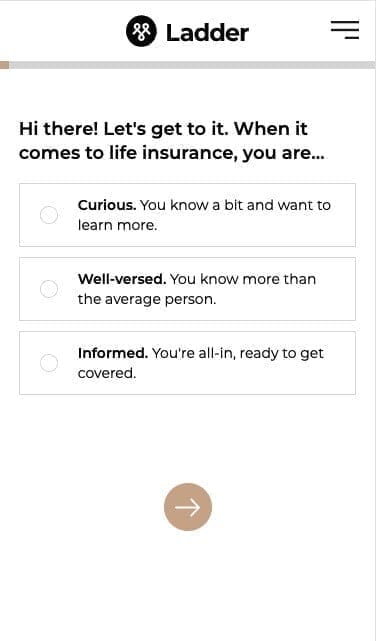

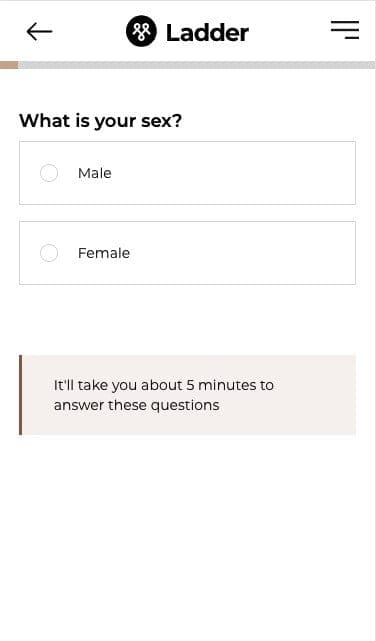

How to get a Ladder Life insurance quote? It starts with a simple questionnaire.

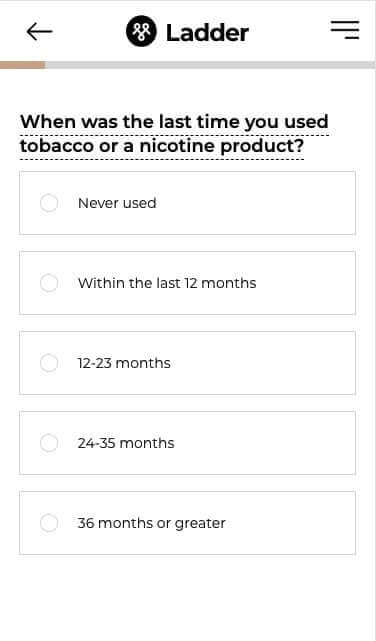

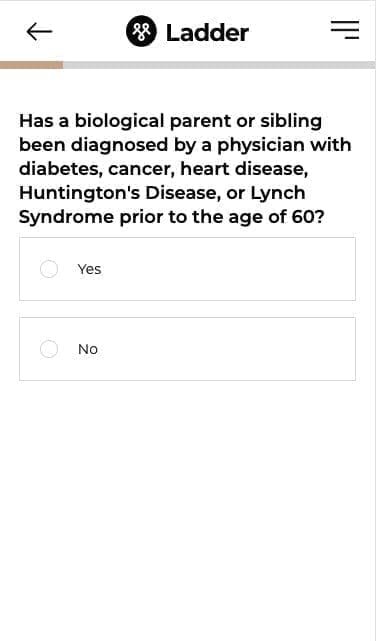

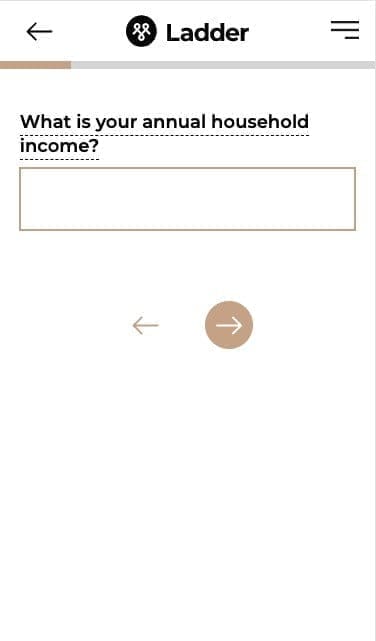

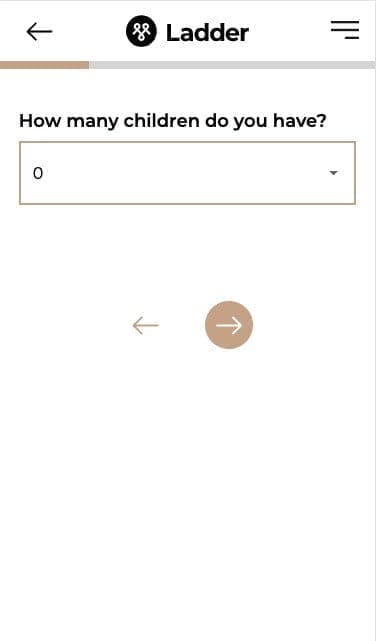

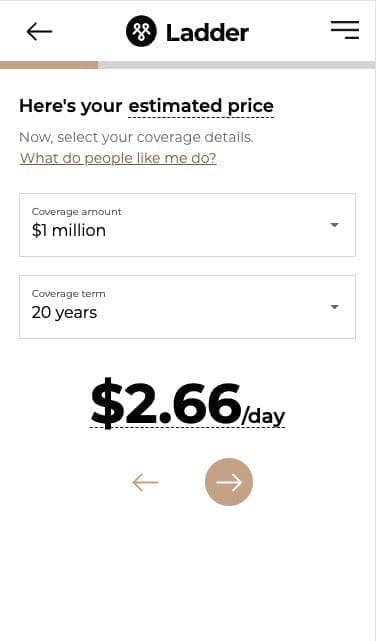

The questions asked are the standard demographic ones around sex, smoker status, etc. See below screenshots of each step of the form.

The company offers fantastic price transparency, allowing you to see your Ladder Life insurance quotes at any term length or coverage amount.

The Ladder Application Process

Ladder’s application has the same question-by-question, chat-like feel as the quote form.

In total, the application was 38 questions (nearly all multiple choice) and took seven minutes to complete.

Does Ladder Make You Take A Medical Exam?

Applicants seeking up to $3M in coverage will not have to take a medical exam and may be offered instant coverage if they check all of the other boxes. (To begin your coverage, you have to make your first payment, which can be done by credit card.)

If Ladder requires additional information, they may ask you to complete a medical exam. While this adds extra time to the process, the exam itself is straightforward.

Which Ladder Policy Is Right For You?

For any life insurance policy, your coverage amount and term length depend on your personal needs.

However, you can use a few rules of thumb to decide how much you need and for how long you need it.

Choosing The Right Coverage Amount

“How much coverage do I need?” is one of the most common questions among those new to life insurance. And this is far from an exact science.

Conceptually, your life insurance needs should reflect the amount of financial support your beneficiaries need if they can no longer rely on your income.

In other words, your LadderLife term insurances coverage needs should take into account, for example, your day-to-day expenses, debt, future financial obligations, and your existing savings.

Choosing The Right Term Length

Another key question centers around the appropriate length of coverage.

Here are some factors you should consider when determining the type of term life policy that’s right for you:

- Your age (one wouldn’t call LadderLife best life insurance for seniors)

- When your mortgage term ends

- When your last child will graduate from college

- When you and your partner plan to retire

You generally want to make sure that your policy lasts beyond these events.

You’ll also want to consider your savings. If you’re a person who saves quite a bit each month, you may need insurance for a shorter term, as you’ll sooner be able to rely on your savings instead of life insurance death benefits to meet your financial needs.

Lastly, the price of your insurance can be a consideration. Longer terms are a bit more expensive per month than shorter terms, affecting the decision you make.

Frequently Asked Questions

What Type of Insurance Does Ladder Offer?

Ladder sells term life insurance exclusively to individuals between 20 and 60 years old.

Is Ladder a legit company?

Yes, LadderLife is a well-known and reputable company. They have excellent customer satisfaction ratings through TrustPilot and have partnered with industry leaders in the life insurance space to offer policies.

Does Ladder pay out?

Yes. While Ladder has been in business since just 2015, the companies who issue Ladder’s policies have been in business for 50+ years and are highly-rated by third-party ratings agencies, like A.M. Best. They have been paying claims and supporting families for decades.

Choose kindness.

You never know what battles people may be fighting.

Conclusion

Is Ladder Life insurance good? If you’re looking for a decent term life insurance, it can certainly be an option to look into.

We hope this Ladder life insurance review has answered all of your questions about Ladder and left you ready to apply for a policy.

If you have any remaining questions, don’t hesitate to leave a comment or contact us by email at hello [at] getsure.org. We’ll be sure to get back to you within 24 hours.

Warm Regards,

The GetSure Team

Ladder Insurance Services, LLC (CA license # 0K22568; AR license # 3000140372) offers term life insurance policies: (i) in New York, on behalf of Allianz Life Insurance Company of New York, New York, NY (policy form # MN-26); and (ii) in all other states and the District of Columbia on behalf of Allianz Life Insurance Company of North America, Minneapolis, MN (policy form # ICC20P-AZ100 and # P-AZ100). Only Allianz Life Insurance Company of New York is authorized to issue life insurance in the state of New York. Insurance policy prices, coverages, features, terms, benefits, exclusions, limitations and available discounts vary between these insurers and are subject to qualifications. Each insurer is solely responsible for any claims and has financial responsibility for its own products.

Article Sources

- Ladder Life. I'm Curious About Ladder

- Ladder Life. I Want To Know About Labs

- TrustPilot. Ladder Life Reviews

- Allianz Life. Allianz Financial Ratings

- A.M. Best. AM Best Comments on Credit Ratings of Allianz Life Insurance Co of North America and Its Subs Following Reinsurance Announcement

One thought on “Ladder Life Insurance Review 2024”

Comments are closed.

I have received quotes from a number of companies and NONE were as invasive and unbelievable as Ladder’s. I answered their original questions and received nothing but requests for my complete medical history, complete physical and blood work before they would respond.

I am in very good health and weight and eat well and workout on a regular basis. If I was asking for a million dollar policy with a 20 year term, I could see some concern. They were over the top and the “public information “ they gathered was not correct. They didn’t care.

Horrible customer service and nothing but denials about their “detective “ like research about my health. Not even close.

I would not waste any of your time with this company.

David Fox