It is always a smart thing to set aside money to pay for large expected expenses. A funeral is always a solemn occasion, but is no different when making informed financial decisions. Planning your funeral can save your loved ones the stress of making all the necessary arrangements during an emotional time.

However, with so many prepaid funeral plans flooding the market, you need to understand how these plans exactly work and the key benefits and financial risks associated with each plan.

After reading this post, you’ll understand what questions you need to ask to choose the plan that best suits your requirements.

Choose kindness.

You never know what battles people may be fighting.

How Does A Prepaid Funeral Plan Work?

A prepaid funeral plan allows you to pay for your funeral arrangements before you pass away. This saves your loved ones the financial and emotional stress of making decisions while grieving and ensures that things are taken care of just the way you had wanted.

Now, there are different ways of doing it. Depending on your financial concerns and preferences, You can pay the funeral home ahead of time or make your payment through a prepaid contract provider. These policies typically range between $10,000 and $25,000 with monthly installments payable directly to the funeral home.

Summary:

- Plan and set aside money for your funeral ahead of time.

- Policies generally range from $10,000 to $25,000. Specify the arrangements you want and choose the best match your budget.

- Pay your monthly installments directly to the funeral home or opt for a prepaid contract provider to take care of your payment schedule.

- The funeral home will have sole access to the money you set aside for your funeral.

- The expenses may be tax-deductible if the estate pays the prepaid funeral costs.

- Please note that every prepaid funeral plan has its financial risks and benefits.

How much do prepaid funeral plans cost?

The typical range of prepaid funeral policies is between $10,000 and $25,000. Several payment options are available, enabling you to choose according to your financial capabilities. The entire amount can be paid upfront or in installments with a three-, five-, or ten-year plan.

You also need to anticipate some additional fees besides the cost of the funeral. This may include administrative setup fees of $100-$200, or yearly maintenance fees ranging from $50-$150.

Are Prepaid Funeral Expenses Tax Deductible?

It’s only normal for you to wonder whether funeral expenses are tax-deductible. Well, it’s important to note that most prepaid funeral expenses are not tax-deductible for individuals. However, the rules change when the estate covers the burial costs.

As per IRS regulations, an estate is allowed to use the expenses against its taxes as a deduction if it uses a prepaid plan to pay the funeral costs.

The tax-deductible aspect of prepaid funeral expenses can sometimes be difficult to comprehend. You should always consult a tax professional to make the right decisions and avoid costly mistakes.

Should You Prepay Funeral Expenses?

While purchasing a prepaid funeral plan seems like a feasible solution, the truth is, there are several risks involved with pre-paying for your funeral and working directly with funeral homes. There are more shrewd and cost-effective ways of paying for your burial.

Detailed investigation performed by state and federal authorities on funeral homes and pre-payment providers has cast light on alarming violations of trust.

That’s because most of these plans don’t have a lot of regulatory oversight, allowing funeral homes to exploit the loopholes and embezzle your funds. Shockingly, some funeral homes go out of business before the need for your last arrangements arises.

Others sell policies that don’t make much sense from a financial perspective. While the Funeral Rule passed by the federal authorities in 1984 offers some consumer protection, state laws are not that impactful and do not always favor consumers.

Putting things into perspective, you may consider taking out a small, final expense life insurance policy as an alternative to purchasing prepaid funeral plans. Several state and federal authorities highly regulate these policies, offer more flexibility, and come with fewer financial risks associated.

What Coverage Do You Get With a Prepaid Funeral Plan?

Prepaid funeral plans typically come with a wide array of customizations, allowing you to include the services and goods you want for your funeral. These policies cover all the costs of your last arrangements, ranging from funeral home services to flowers, casket, transportation, and everything in between. The funeral home director you choose to work with will quote a final price once you’ve made a complete list of everything you want to be included in your policy.

When purchasing a guaranteed prepaid funeral plan, all the goods and services you want for your funeral are specified, and the price you agree to pay is locked in. This protects your loved ones from the hassle of meeting additional expenses even if the prices were to rise in the future. Please note that non-guaranteed plans don’t come with such protection.

How to Get Started?

You can either work directly with the funeral home or opt for a prepaid contract provider while paying for a prepaid funeral plan. These providers collaborate with multiple funeral homes and take care of all the arrangements for the plan payments. A payment plan will be set up with the funeral home or provider after you select all the goods and services you want for your funeral.

Check Out: Why Prepaid Funerals Might Not Be the Best Choice

Choose kindness.

You never know what battles people may be fighting.

Prepaid funeral plans: Pros & Cons

Before considering purchasing one, you need to comprehensively understand the pros and cons of prepaid funeral plans.

Pros:

- Allows you to pay in advance and take care of all the details of your funeral so that your loved ones do not have to handle the stress of making the arrangements after you’re gone.

- You get to ensure that your funeral is handled just as you envisioned. You can even choose the type of funeral and the cemetery plot you wish to lie in.

- Guaranteed plans enable you to lock in the current market prices for your last arrangements, meaning that your family members wouldn’t need to pay any additional fees if the prices were to go up.

- Purchasing a prepaid plan can be useful if you are adamant about a specific funeral home handling your final arrangements. This ensures that your final wishes are honored.

Cons:

- Despite your best efforts, your loved ones could be forced to pay for your last arrangements if the funeral home you choose goes out of business for some reason.

- Most prepaid funeral plans are non-transferable, and complexities could arise if you relocate or die in a different location. The funeral home you choose may or may not transfer the policy to a new funeral home.

- These plans are often non-refundable, meaning that you may not be entitled to a refund if you change your mind later on and decide to pay differently for your funeral.

- Purchasing a prepaid funeral plan can take a toll on your savings. Your family may not have sufficient funds to pay your medical bills and cover other end-of-life expenses.

Burial insurance plans are a better option

Purchasing a funeral insurance policy, also known as final expense insurance or burial insurance, is one way of paying for your funeral expenses ahead of time.

These life insurance policies allow you to assign a beneficiary, such as a family member or a trusted friend, to receive the death benefit.

While prepaid funeral plans come with their own limitations, life insurance benefits can be used to cover various costs.

In addition to paying for funeral expenses, beneficiaries can use them to pay medical bills, credit card debt, utility costs, and more.

Some states also allow you to list a funeral home as your beneficiary. Your family must trust the funeral home to handle your death professionally and honestly.

However, you must know that any funds may not be left over for your family if you make a funeral home your beneficiary.

Average Funeral Expenses

Funerals can be costlier than you would have ever imagined. According to a survey by The National Funeral Directors Association (NFDA), the median cost for a funeral without a vault was $7,848 in 2021. The expenses escalated to a whopping $9,420, including the vault. Surprisingly, these figures do not include the burial plot, headstone, or obituary. Here is the median funeral cost checklist as published by the NFDA in 2021:

| Item | Cost |

|---|---|

| Funeral home’s basic service fee (indeclinable) | $2,300 |

| Transporting remains to funeral home | $350 |

| Embalming | $775 |

| Preparing the body in other ways, such as makeup and hairstyling | $275 |

| Facilities and staff to manage a viewing | $450 |

| Facilities and staff to manage a funeral ceremony | $515 |

| Hearse | $350 |

| Service Car | $150 |

| Basic memorial printed package | $183 |

| Metal casket | $2,500 |

| Median cost of funeral with viewing and burial | $7,848 |

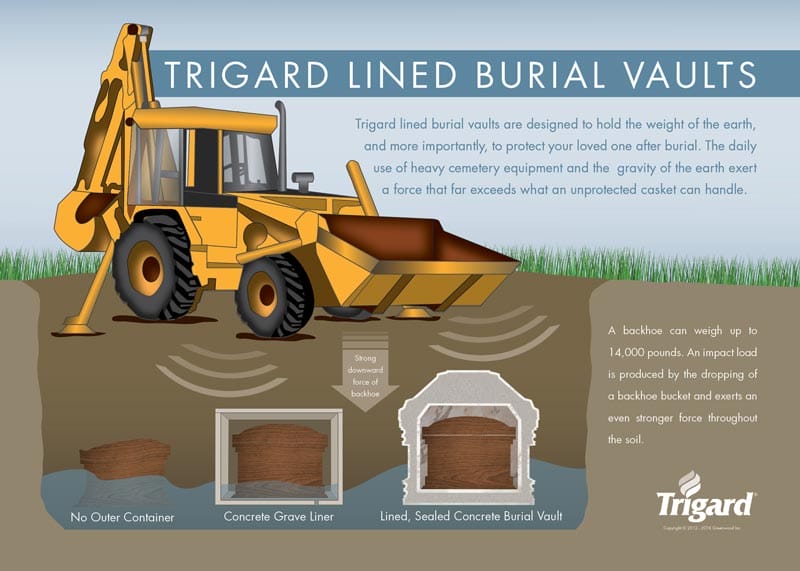

| Vault | $1,572 |

| Cost with Vault | $9,420 |

Comparison Between Prepaid Funeral Plan and Funeral Insurance

A prepaid funeral plan might seem similar to a funeral insurance policy. However, there is a fine line of difference between the two. In the case of a prepaid policy, the payments are made directly to the funeral home that has sole access to the money. However, your family may or may not have to cover additional funeral expenses, whether the plan is guaranteed or not.

On the contrary, a funeral insurance policy makes room for more flexibility. These policies allow you to assign any beneficiary you want. The assigned beneficiary can use the payout for your funeral expenses, final utility payments, medical bills, and other outstanding expenses. Any leftover money will be at your beneficiary’s discretion for use.

| Funeral Insurance | Prepaid Funeral Plan |

|---|---|

| Extremely flexible – Suitable for use globally | Extremely limited – Can only be used by the funeral home from which it was purchased |

| The availability of policy riders offers additional benefits | Additional benefits aren’t usually available. |

| The payment is made directly to the beneficiary. | The funeral home is the direct recipient of the money. |

| Funeral services can be price-shopped by families to secure the best deals. | The funeral home sets all the prices, meaning that there is no provision for price-shopping. |

| Policy benefits can be split among multiple individuals or organizations. | The funeral home remains the sole recipient of the policy benefit. |

| Funeral insurance policies build cash value that facilitates the withdrawal of funds in the form of a policy loan. | There is no guarantee that these plans would build cash value. |

What are Prepaid Funeral Trusts?

- An interest-bearing account is used for the deposition of the payments.

- The money you invest accumulates interest throughout your lifespan and is used by your survivors to pay for your funeral.

- Funeral homes have varying degrees of authority over your money due to the differences in state laws.

- Your Medicaid qualification criteria aren’t affected by purchasing a prepaid funeral plan.

- The funeral amount is capped from $5,000-$15,000 by many states.

- Designating a joint bank account allows immediate access to funds without waiting for estate settlement.

- You can name a beneficiary while setting up a Payable on Death (POD) account. However, you will remain in charge of the funds until you pass away.

You will receive a trust-based pre-payment plan if you work directly with the funeral home. Your payments will be deposited into an interest-bearing account, and the money will accumulate interest until you breathe your last. Once you pass away, your survivors can use the money to pay for your funeral.

However, there is more to it than you think. The funeral home must only put up to 60% of the payments into the account, depending on your state.

In addition, they can keep up to 10 percent or more for administrative fees, lock the trust, and use your money to pay their administrative fees if you miss your payments for some reason.

It might be surprising but things can actually get worse if you decide to cash out the trust. Some states allow funeral homes to keep up to 30 percent of your hard-earned money.

Irrevocable vs. Revocable Trusts

The difference between the two is very simple. Putting pen to paper on an irrevocable trust means that the contract between you and the funeral home is permanent and can’t be altered under any circumstances to claim a refund. This is also essential for you to qualify for a Medicaid exclusion.

On the contrary, signing a revocable trust allows you the freedom and the peace of mind to change your decision and receive a refund.

Choose kindness.

You never know what battles people may be fighting.

Factors to Consider Before Pre-Paying

Ask yourself the following questions before purchasing a prepaid funeral plan:

- Does the policy make sense financially?

- What is the pay-off duration of the policy?

- What happens when a person passes away before making all the payments toward the policy?

- What if the funeral home closes or changes ownership before your last arrangements occur?

- Does your state have adequate consumer protection laws to preserve your best interests?

- What exactly are the funeral benefits that you get for your investment?

- What happens if you relocate to a different city or die elsewhere?

- What happens if the prices of your chosen goods and services increase before you pass away?

- How does the interest accumulated on the payments affect the overall scheme?

- Are you entitled to a refund if you change your mind and look for other options?

- Who gets the leftover money after your funeral?

Prepaid Funerals & Medicaid

Purchasing a prepaid funeral plan won’t affect your eligibility to qualify for Medicaid. However, please note that several states limit the amount you can put in a funeral trust from $5,000 to $15,000.

Popular Prepaid Funeral Arrangements & Services

While not all prepaid funeral insurance plans are the same, you can customize your policy with the specific goods and services you want. However, you must remember that your choices and decisions directly impact the policy amount. Here’s a brief overview of what most preset plans include:

- Funeral home expenses

- The death certificate

- Clergy expenses

- Burial cost

Please note that funeral expenses, such as the cost of the casket, headstone, or cemetery plot are not covered by all funeral plans. In most cases, you can work directly with a funeral home to purchase a customized plan that meets your financial requirements.

Creating a Joint Bank Account

A person’s assets may be temporarily unavailable to his or her family members upon death until the estate is settled. Even if funds are available in the account, their loved ones will still be unable to use it to pay for the funeral.

Setting up a joint account can solve the problem, with the designated survivor having immediate access to the funds.

If you find it difficult to make consistent deposits and leave the balance alone, consider choosing other options that better suit your needs.

Setting up a Payable on Death Account

A Payable on Death (POD) Account is also known as Totten Trusts, deriving its name from a 1904 New York court decision. This type of account can be set up through your bank and allows you to name a beneficiary to whom the funds will be available upon death.

However, you will have the right to withdraw money, move or close the account, or even change the beneficiary while you are alive. Please note that a POD account avoids probate.

Using an Existing Life Insurance Policy

You can also use an existing life insurance policy, either term life or whole life, to cover your funeral costs. You need to ensure that your beneficiaries know exactly what fraction of the death benefit they should use to plan for your last arrangements.

However, it is imperative to state that term insurance can expire before a person’s death and, if not renewed, leaves no death benefit to the beneficiary.

Purchasing a Final Expense Policy

Also known as burial insurance or funeral insurance, this type of life insurance policy can be purchased from insurance companies.

A final expense policy provides full coverage for funeral expenses and includes other end-of-life costs, including medical bills, hospice care, and more. In most cases, you must answer a few health-related questions while purchasing this policy. These plans offer death benefits ranging between $10,000 and $25,000.

Family Communication is Essential, Irrespective of the Policy You Choose

You might include all the details of your prepaid funeral policy in your will, but there are high chances that your grieving family members won’t read it before the funeral. Hence, communicate the details of your prepaid funeral policy with your family.

Conversely, some people put in a lot of effort in choosing the prepaid funeral plan or insurance policy that best suits their family but fail to communicate the same to them. The family members typically discover the policies kept securely in a safe deposit box much after the funeral.

In either situation, your best efforts to secure your loved ones financially during a tough time would go in vain, as your family will be without the knowledge of your funeral policy and ultimately end up making arrangements and paying for it. No matter what prepaid plan you opt for, it is important that your family members are aware of the arrangements and have access to the important documents.