- 93 Companies reviewed

- 50 Features considered

- 4,650 Data points analyzed

We collected 4,650 data points from 93 life insurance companies to measure financial stability, customer satisfaction, product and feature variety, and the overall buying experience. We then evaluated each company based on 50 metrics to develop unbiased, comprehensive reviews.

Choose kindness.

You never know what battles people may be fighting.

Who Is Ethos Life Insurance?

Launched in 2016, Ethos Life Insurance is one of several companies bringing life insurance online.

Like many of its competitors (e.g., Bestow, Fabric, and Haven Life), Ethos has a fully online application that takes 10-15 minutes to complete. Even better, most applicants do not have to take a medical exam.

Ethos offers term life insurance coverage for younger customers from $50,000 to $1.5 million. For seniors looking to fund their final expenses, Ethos sells burial insurance policies with coverage under $25,000.

| Attribute | Details |

|---|---|

| Founded | |

| Address | 460 Bryant St San Francisco, CA 94107 |

| [email protected] | |

| Phone | (415) 322-2037 |

| Website | https://www.ethoslife.com/ |

| BBB Rating | A+ |

| A.M. Best Rating | A+ (Superior) |

Ethos is based in San Francisco, CA, and has an A+ rating from the Better Business Bureau. You can reach their customer service team by email at [email protected] and by phone at (415) 322-2037.

Ethos Has Brought The Application Process Online

Ethos is a life insurance broker. It focuses on the customer-facing aspects of life insurance, from the application process to customer service., Ethos’ focus on innovation has paid off for the custom in both respects.

The Ethos website has a wealth of knowledge on life insurance, helping you avoid unnecessary calls to customer service. In terms of the purchase process, Ethos’ technology has brought the entire process online, from quote to policy signing.

After you apply, Ethos analyzes your information against its insurance products in real time and matches you with the best policy and price available.

You can always speak to an agent if you would like to. But if you prefer not to, you never have to.

Is Ethos Insurance Legit?

Ethos will not leave you hanging when it comes time to pay out on claims. In fact, it couldn’t if it wanted to!

Why? As mentioned above, Ethos is a life insurance agent. It can sell policies, but a licensed carrier must issue the actual life insurance policy and pay out any claims.

For this reason, Ethos has partnered with three highly reputable life insurance companies (carriers):

- Legal & General America (a.k.a. Banner Life Insurance), a carrier that was founded in 1941 and that currently holds an A+ (Superior) financial strength rating from A.M. Best (a life insurance ratings agency well-known for rating an insurance carrier’s claims-paying ability)

- Ameritas Life Insurance Corp. is a highly-rated life insurance company issuing policies and paying claims since 1887. Ameritas has an A (Excellent) rating from A.M. Best and an A+ rating from the BBB

- AAA Life Insurance Company is a life insurance carrier founded in 1969 and is a subsidiary of the well-known “Triple A” brand. AAA Life has an A (Excellent) rating from A.M. Best

Each of these companies has been issuing policies and successfully paying claims for over 50 years.

So you can rest assured that these companies are not going anywhere and that AAA Life will pay your beneficiary.

Ethos Is Confident In Its Product

Here’s one of the best features of Ethos policies:

If you decide you don’t want your life insurance coverage within the first 30 days for any reason, Ethos will refund your payment in full and cancel your policy.

Ethos Life Insurance Policies

Unlike most online insurance agencies, Ethos offers life insurance to many ages, from millennials to seniors.

Term Life Insurance

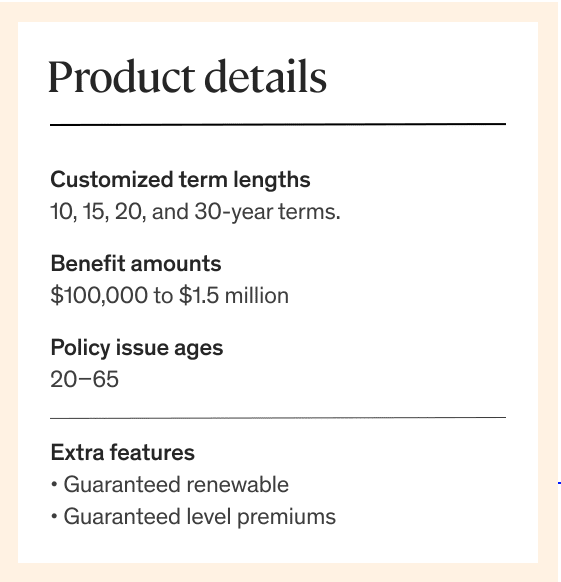

Ethos’ main product is term life insurance. U.S. residents between the ages of 20 and 65 are eligible to apply.

Ethos’s term life policies come with term lengths of 10, 15, 20, or 30 years. Coverage amounts range from $100,000 to $1.5 million.

Finally, Ethos’ life insurance policies have level premiums, which means your premiums never increase over the term of your policy, no matter what happens to your health.

Guaranteed Issue Whole Life Insurance

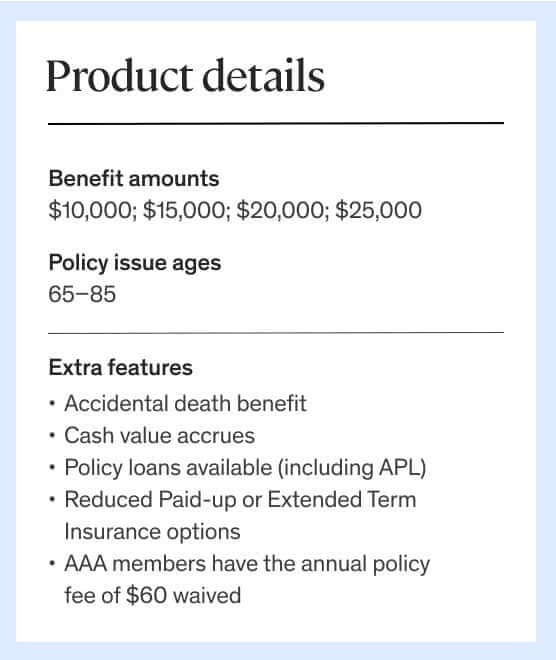

For the senior market, Ethos sells guaranteed issue whole life insurance policies (also known as a guaranteed acceptance whole life insurance), with death benefit amounts ranging from $10,000 to $25,000.

Like most whole life insurance, these policies build cash value and allow policy loans. These low-coverage, guaranteed issue whole life policies are often referred to as burial insurance, funeral insurance, or final expense insurance, given the intended use of the death benefit.

Since this policy is “guaranteed issue,” no medical exam is required (not even a few health questions on the application).

This policy allows seniors to fund their own end-of-life expenses and avoid leaving their loved ones with a financial burden.

For life insurance products such as these, Ethos competes with well-known burial insurance issuers, including Colonial Penn, Globe Life, Lafayette Life Insurance, and Mutual of Omaha.

The policy is issued by AAA Life Insurance and includes an accidental death benefit rider. If the insured dies in an accident, the accidental death benefit rider pays the beneficiary double, or even triple, the original death benefit.

Finally, while the policy has a $60 “initiation fee,” the fee is waived for Triple A members.

Check Out: Whole Life Insurance from TruStage

Check Out: Baltimore Life Insurance Company Overview

Choose kindness.

You never know what battles people may be fighting.

Ethos Life Pros & Cons

So, where do things shake out in the end?

Let’s look at the pros and cons of buying an Ethos life insurance policy.

Pros

- With Ethos, you can get up to $1.5 million in term life insurance coverage, which is higher than most online life insurers.

- Ethos’ application is 100% online and does not involve a medical exam (for policies under $1 million). It takes less than 15 minutes to complete, does not affect your credit score, and asks for basic information about your identity, lifestyle, and medical history.

- Ethos’ term life policies include an accelerated death benefit rider. This means that you get a portion of your payout BEFORE you die if you have a critical illness with <24 months to live.

Cons

- With no medical exam, Ethos gets less data on the riskiness of each applicant. To make up for this, they have to charge more. We found that Ethos’ life insurance rates were ~10-15% higher than fully-underwritten policies.

- Ethos lacks a traditional whole life insurance product. One that is available to all ages and offers enough coverage to provide income replacement, as most life insurance policies have traditionally done

- While Ethos gets 4.6 stars (out of 5) overall from 407 customer reviews, a handful of customers reported delays in approval, making the process take far longer than advertised

Ethos Life Insurance FAQs

Is Ethos Life Legit?

Ethos is a highly-reputable life insurance broker with an A+ rating from the Better Business Bureau. To issue its policies and pay out on claims, Ethos has partnered with some of the most highly-rated carriers in the insurance industry (e.g., Ameritas Life Insurance Corp, which has been going strong since 1887!), both of whom have an A+ financial stability rating from A.M. Best.

Does Ethos Require A Medical Exam?

Most customers do not have to take a physical (only those with existing health conditions and those looking for more than $1 million in coverage). Others need to complete a 10-minute online application, after which Ethos will let you know if you are denied, or approved or whether your approval is contingent on additional information.

How Much Did Ethos Raise?

According to Crunchbase, Ethos has raised $106.5 million in funding over its four equity funding rounds (Seed through Series C) from a well-respected group of Silicon Valley venture capital firms, namely Sequoia Capital, Goldman Sachs, Google Ventures, and Accel, among others.

Is Ethos An Insurance Carrier?

No, Ethos Life is not an insurance carrier. Ethos is a life insurance agency that sells policies on behalf of many of the top life insurance carriers in the United States. Ethos’ offerings include term life insurance, for its younger customers, as well as burial insurance coverage for seniors.

What Companies Does Ethos Use?

Ethos has partnered with three life insurance carriers to issue its policies. For term life insurance, Ethos works with Legal & General America (a carrier rated A+ by A.M. Best) and Ameritas Life Insurance Corp (rated A). For its whole life insurance policies, Ethos works with AAA Life Insurance Company (an A-rated carrier), a subsidiary of the well-known Triple A brand.

Conclusion & Key Takeaways

It’s hard not to like Ethos. They offer:

- A smooth, 100% online experience

- More product diversity than competitors like Bestow, Fabric, Health IQ, and Haven Life

- Greater focus on the customer, as shown by the many high-quality customer education resources on their website.

Given Ethos’ 30-day money-back guarantee (and their no-fee cancellation policy after that), do you really need more reasons to put in an application with Ethos?

Either way, that should do it for this review of Ethos Life Insurance!

If you have any questions, don’t hesitate to leave a comment below or email us at hello [at] getsure.org, and we’ll be sure to get back to you within 24 hours.

Warm Regards,

The GetSure Team

Article Sources

- Better Business Bureau. Ethos Technologies, Inc

- TrustPilot. Ethos Life Customer Reviews

- Ethos Life. Term life insurance policies

- Ethos Life. Whole life insurance policies

- Ethos Life. YouTube Channel