- 93 Companies reviewed

- 50 Features considered

- 4,650 Data points analyzed

We collected 4,650 data points from 93 life insurance companies to measure financial stability, customer satisfaction, product and feature variety, and the overall buying experience. We then evaluated each company based on 50 metrics to develop unbiased, comprehensive reviews.

Choose kindness.

You never know what battles people may be fighting.

Who Is Globe Life Insurance Company?

Founded in 1900, Globe Life Insurance Company is a Fortune 500 company based in Plano, Texas. Globe Life provides insurance to 4.3 million policyholders with over $86 billion in in-force coverage.

Globe Life is one of the largest providers of burial life insurance (also known as “funeral insurance” or “final expense insurance”) in the United States, competing with other burial insurance companies, such as Mutual of Omaha, Liberty Bankers Life, and Prosperity Life Group.

Globe Life holds an A (Excellent) financial strength rating from A.M. Best and an A+ rating from the Better Business Bureau.

| Attribute | Details |

|---|---|

| Founded | 1900 |

| Address | 3700 S. Stonebridge Drive McKinney, TX 75070 |

| https://www.globelifeapplication.com/contact | |

| Phone | (800) 742-6787 |

| Website | https://www.globelifeinsurance.com/burial |

| BBB Rating | A+ |

| A.M. Best Rating | A (Excellent) |

Because insurance is regulated country by country, the Company is not a global life insurance company.

So, is Globe Life Insurance good? Let’s find out.

Note: If you’re looking for an abbreviated version of this Globe Life review, please check out our article on the pros and cons of Globe Life insurance.

Check Out: Mutual of Omaha Life Insurance Reviews

Renewable Term Life Insurance

Globe Life offers two policies that can be classified as burial insurance.

How do we know which life insurance policies can be classified as funeral insurance? First of all, funeral insurance policies are whole life insurance policies. They have smaller death benefits because these are sized to cover an individual’s final expenses, such as funeral costs and burial expenses:

- Renewable Term Life Insurance

- Guaranteed Issue Life Insurance

For both of these policies, when you apply, you’ll also have the option of adding accidental death insurance and/or children’s whole life insurance to your policy.

Renewable Term Life Insurance

Globe’s primary burial insurance offering significantly differs from other final expense insurance companies.

This is because the policy is NOT a whole life insurance policy. It is a “term-to-age-90” product, meaning coverage ends at age 90, no matter what.

Globe Life’s widely advertised burial insurance policy is NOT whole life insurance. Coverage ends at age 90, and the policy cannot be renewed.

Technically, the policy is a renewable term life insurance policy. Except for your first term period, your term length will be five years, after which you can renew.

All renewal periods begin at your “5-year plus one” age (e.g., 51, 56… 76, 81, 86). Therefore, your initial term period will be either 1, 2, 3, 4, or 5 years in duration, depending on how far you are from one of these “5-year plus one” ages.

This is a lot simpler than it may sound. For example, if you purchase a policy at age 53, your initial term period will last until you are 56. After that, your policy will renew at 61, 66, 71, etc.

The only exception is the final four-year period that begins at age 86. This period ends at the policy anniversary following the insured’s 90th birthday when the policy expires and coverage terminates.

Coverage Limits Vary By Age

Coverage comes in discrete amounts:

- $5,000

- $10,000

- $20,000

- $30,000

- $50,000

- $75,000

- $100,000

Coverage maximums vary by age:

- Those under 60: $100,000

- Those over 60: $50,000

- Those over 70: $30,000

Medical Exam

If you’re wondering if Globe Life Insurance is good for seniors, this might be the main selling point.

Globe Life does not require a medical exam or ask health questions. It is, in effect, a guaranteed acceptance policy (in other words, coverage cannot be denied).

Your medical history does not matter at all. It does not matter if your health history includes a mental or nervous disorder, heart disease, or drug or alcohol abuse, even if you’re in a hospital or nursing facility!

Riders

Globe Life does not offer policy riders. However, there is such a thing as Globe Life Insurance for grandchildren — you can add whole life insurance for children (or grandchildren) during the application process.

Choose kindness.

You never know what battles people may be fighting.

Guaranteed Issue Life Insurance

Globe’s less advertised burial insurance offering is its guaranteed acceptance life insurance coverage option.

You are guaranteed to be approved if you are between 65-80 years old. If unsatisfied, you can return your policy within 30 days (no questions asked) and receive a full refund for premiums paid.

Globe Life’s guaranteed acceptance life insurance policy does not require medical exams, and you will not have to answer health questions.

Unfortunately, you cannot apply for this policy online (or get a quote), but you can call (800) 541-4600, and a Globe Life representative will walk you through the application process.

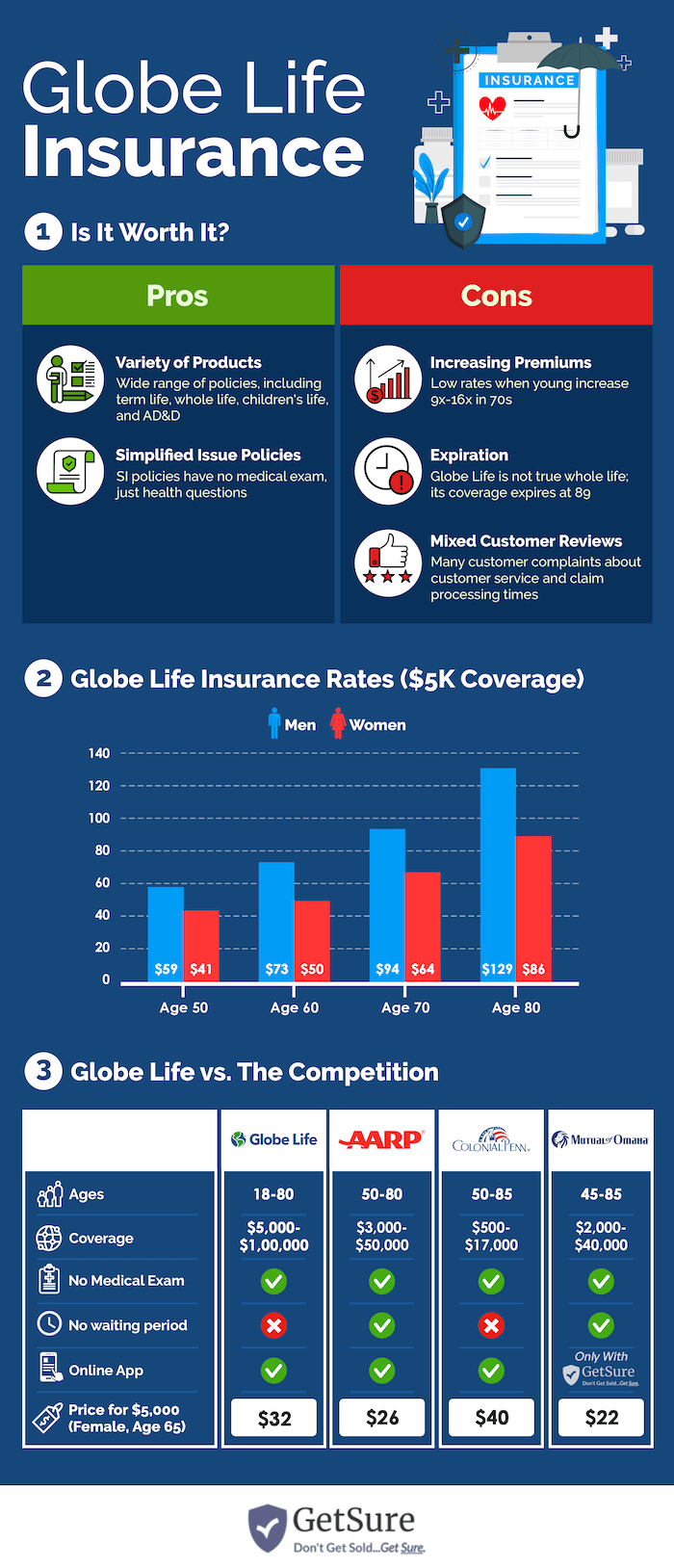

Globe Life Insurance Rates

Globe Life’s funeral insurance is a renewable term life insurance policy. Adults can buy coverage ranging from $5,000 to $100,000 at the rates shown below:

Male Rates for Life Insurance

Let’s take a look at Globe Life insurance rates chart.

| Ages | $5,000 | $10,000 | $20,000 | $30,000 | $50,000 | $75,000 | $100,000 |

|---|---|---|---|---|---|---|---|

| 18-20 | $1.99 | $2.82 | $4.46 | $6.11 | $9.41 | $13.54 | $17.68 |

| 21-25 | $2.32 | $3.37 | $5.48 | $7.59 | $11.79 | $17.05 | $22.32 |

| 26-30 | $2.92 | $4.35 | $7.23 | $10.1 | $15.86 | $23.04 | $30.24 |

| 31-35 | $3.57 | $5.47 | $9.27 | $13.07 | $20.67 | $30.17 | $39.67 |

| 36-40 | $4.22 | $6.63 | $11.45 | $16.28 | $25.92 | $37.98 | $50.04 |

| 41-45 | $5.07 | $8.17 | $14.36 | $20.55 | $32.95 | $48.44 | $63.92 |

| 46-50 | $6.39 | $10.54 | $18.85 | $27.16 | $43.78 | $64.54 | $85.32 |

| 51-55 | $7.7 | $13 | $23.61 | $34.21 | $55.42 | $81.93 | $108.45 |

| 56-60 | $9.34 | $16.14 | $29.74 | $43.35 | $70.56 | $104.57 | $138.58 |

| 61-65 | $11.47 | $20.28 | $37.89 | $55.5 | $90.71 | $134.73 | $178.76 |

| 66-70 | $14.5 | $26.19 | $49.58 | $72.96 | $119.75 | $178.21 | $236.68 |

| 71-75 | $19.17 | $35.38 | $67.81 | $100.24 | $165.1 | $246.16 | $327.22 |

| 76-80 | $26.38 | $49.72 | $96.41 | $143.11 | $236.49 | $353.21 | $469.94 |

| 81-85 | $39.49 | $75.99 | $148.99 | $221.99 | $367.99 | $550.49 | $733 |

| 86-89 | $54.49 | $106.99 | $211.99 | $316.99 | $526.99 | $789.48 | $1051.97 |

Life Insurance Monthly Rates for Women

| Ages | $5,000 | $10,000 | $20,000 | $30,000 | $50,000 | $75,000 | $100,000 |

|---|---|---|---|---|---|---|---|

| 18-20 | $2.22 | $3.71 | $6.69 | $9.68 | $15.65 | $23.11 | $30.58 |

| 21-25 | $2.86 | $4.81 | $8.71 | $12.62 | $20.43 | $30.19 | $39.94 |

| 26-30 | $3.49 | $5.91 | $10.75 | $15.6 | $25.28 | $37.38 | $49.48 |

| 31-35 | $4.16 | $7.1 | $12.98 | $18.86 | $30.62 | $45.31 | $59.99 |

| 36-40 | $5.12 | $8.81 | $16.17 | $23.54 | $38.28 | $56.7 | $75.11 |

| 41-45 | $6.4 | $11.11 | $20.51 | $29.92 | $48.73 | $72.24 | $95.76 |

| 46-50 | $8.1 | $14.18 | $26.34 | $38.5 | $62.83 | $93.23 | $123.64 |

| 51-55 | $10.12 | $17.91 | $33.49 | $49.06 | $80.21 | $119.14 | $158.08 |

| 56-60 | $12.94 | $23.16 | $43.6 | $64.03 | $104.9 | $155.99 | $207.09 |

| 61-65 | $17.02 | $30.84 | $58.49 | $86.14 | $141.44 | $210.55 | $279.67 |

| 66-70 | $22.99 | $42.24 | $80.73 | $119.23 | $196.23 | $292.48 | $388.73 |

| 71-75 | $31.92 | $59.54 | $114.79 | $170.04 | $280.54 | $418.66 | $556.79 |

| 76-80 | $41.9 | $79.46 | $154.59 | $229.72 | $379.98 | $567.81 | $755.64 |

| 81-85 | $57.99 | $111.99 | $219.99 | $327.99 | $543.99 | $813.98 | $1083.98 |

| 86-89 | $81.99 | $161.49 | $320.49 | $479.49 | $797.49 | $1194.99 | $1592.5 |

Life Insurance Monthly Rates for Children

Below is the rate sheet for Globe’s juvenile whole life insurance product.

Globe Life Reviews & Ratings

Now you know our view on Globe, but what do customers and third parties think?

Globe Life Financial Ratings

Financial strength ratings measure an insurance company’s ability to pay out its claims.

Independent rating agencies, such as A.M. Best, S&P, and Fitch, assign insurance companies financial strength ratings based on detailed audits of their financial health.

Globe Life Insurance ratings are impressive when it comes to all three major insurance ratings agencies:

- A.M. Best: A (Excellent)

- S&P: AA-

- Fitch: A+

A.M. Best is the most prestigious of the three, and Globe Life has earned an A (Excellent) rating from them for the past 45 years.

Their reviews of Globe Life Insurance reflect on the Company’s “very strong operating performance, favorable business profile, and appropriate enterprise risk management.”

Globe Life BBB Ratings

BBB gave Globe Life a rating of A+. The Company has been BBB-accredited since 1952.

This rating represents the BBB’s opinion of how Globe Life is likely to interact with its customers and Globe’s effort to resolve any consumer complaints.

Choose kindness.

You never know what battles people may be fighting.

Globe Life FAQs

How long does it take Globe Life to pay a claim?

As indicated in our Globe Life Insurance review (and the company website), it takes 10 to 15 business days for your check to arrive following the date that your claim gets processed. If you haven’t received your check within 30 days of having your claim processed, you should reach out and contact Globe directly.

Conclusion

So is Globe Life Insurance legit?

That’s for you to decide, and hopefully, this review helped you determine whether or not to apply for Globe burial insurance!

If you have any additional questions, please don’t hesitate to send us an email or leave a comment, and we will get back to you within 24 hours.

Warm Regards,

The GetSure Team

Article Sources

- Globe Life. Burial and Funeral Insurance

- Globe Life. Children's Life Insurance

- Globe Life. Term Life Insurance