Note: This article will focus exclusively on AARP life insurance rates for seniors. For a full review of the AARP-New York Life insurance program, see our full analysis of AARP-NYL’s offerings.

AARP is a fantastic organization with a great reputation.

When it comes to life insurance, there is one thing that matters above all else: trust. People trust the AARP brand and, therefore, are eager to check out AARP life insurance rates.

Let’s see what these rates look like for their three products:

- Guaranteed Acceptance Life Insurance

- Permanent Life Insurance

- Level Benefit Term Life Insurance

Choose kindness.

You never know what battles people may be fighting.

AARP Term Life Insurance Rates

First up, we have the Level Benefit Term Life Insurance Product from New York Life and AARP.

Use the tabs below to toggle between rates for men and women, smokers vs. non-smokers.

AARP Term Life Insurance Rates Chart (Ages 50-74)

4 Key Features Of AARP’s Term Life Insurance

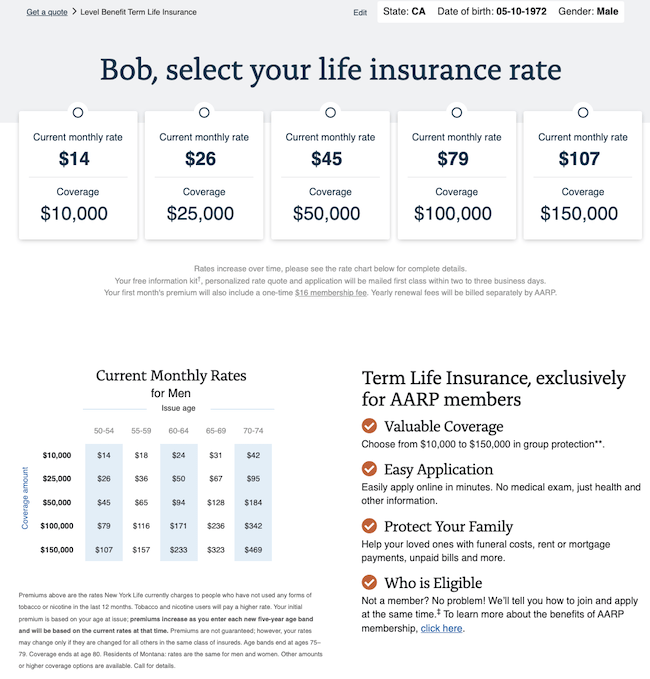

When you request a quote from AARP, you’re presented with a page that looks like this:

There are three things worth noting here that are not obvious at first glance:

Wide Coverage Options

While it may look like you can get coverage in only the five amounts shown below, once you enter their application, you can choose a more precise level of coverage. You can buy a term life insurance policy from AARP in increments of $500, from $10,000 to $150,000.

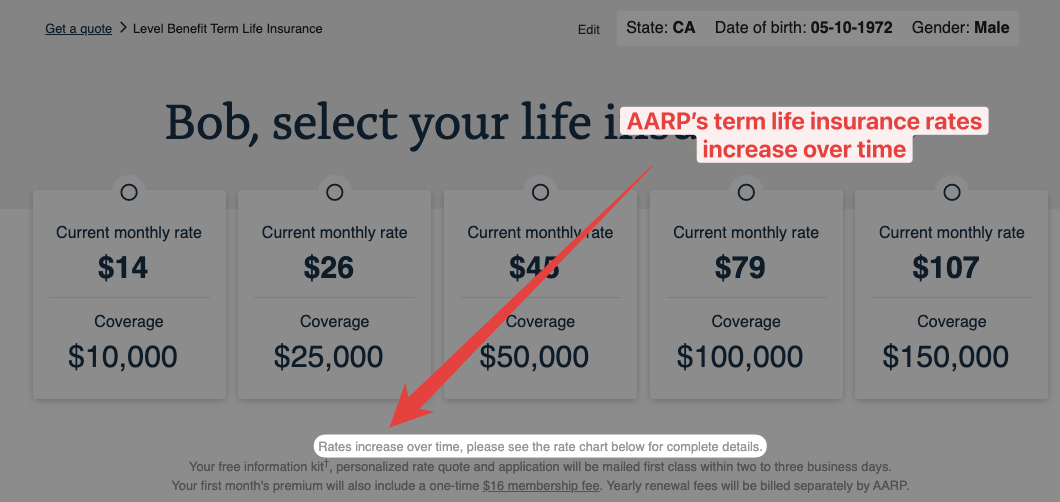

Increasing Rates

AARP’s term life insurance rates increase over time (every five years).

These rate increases are similar to Globe Life’s policies, whose rates also increase every five years. However, AARP is more upfront about this fact, as it lays out a table of your future rates towards the bottom of the page, as shown below.

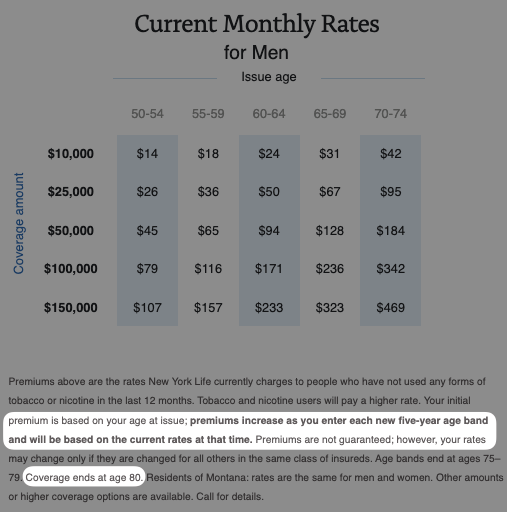

Here’s how to read this table:

- If a non-smoking male buys a $50,000 policy at age 53, his rate would be $45/month

- At age 55, this would increase to $65/month

- At age 60, his rate would increase again to $94/month

- At age 65, his rate would be $128/month

- Finally, when he turned 70, his rate would increase to $184/month (more than 400% his initial rate!)

Non-Guaranteed Rates

Unlike most life insurance plans, which have level (or flat) premiums, AARP’s policies have rates that increase every five years.

Coverage Ends at 80

Finally, as shown towards the bottom of the footnote, “coverage ends at age 80”.

AARP Guaranteed Acceptance Whole Life Insurance Rates

The first of AARP’s three life insurance products that we will cover is its guaranteed issue life insurance product.

As shown in the tables below, the rates are fairly high. There are two reasons for this:

The first is that the rate is locked in for life (as long as you continue paying your premiums). Whereas Term Life rates rise whenever you enter a new five-year age band, Guaranteed Acceptance rates stay the same over the policy’s life. Because AARP Guaranteed Acceptance Life provides acceptance without medical underwriting, the premium includes an extra mortality risk charge.

AARP Life Insurance Rates For Men (Ages 50-80)

| Age | $5K | $10K | $15K | $25K |

|---|---|---|---|---|

| 50 | $30 | $59 | $88 | $146 |

| 51 | $31 | $61 | $91 | $150 |

| 52 | $32 | $63 | $93 | $155 |

| 53 | $33 | $65 | $96 | $159 |

| 54 | $34 | $67 | $99 | $164 |

| 55 | $35 | $69 | $102 | $169 |

| 56 | $36 | $71 | $105 | $175 |

| 57 | $37 | $73 | $109 | $180 |

| 58 | $38 | $75 | $112 | $186 |

| 59 | $40 | $78 | $116 | $192 |

| 60 | $41 | $80 | $120 | $199 |

| 61 | $42 | $83 | $123 | $204 |

| 62 | $43 | $85 | $127 | $210 |

| 63 | $44 | $87 | $130 | $215 |

| 64 | $45 | $89 | $133 | $220 |

| 65 | $46 | $91 | $136 | $225 |

| 66 | $48 | $94 | $140 | $223 |

| 67 | $49 | $97 | $145 | $241 |

| 68 | $51 | $101 | $151 | $250 |

| 69 | $53 | $105 | $157 | $260 |

| 70 | $55 | $108 | $161 | $268 |

| 71 | $56 | $111 | $165 | $275 |

| 72 | $57 | $113 | $169 | $281 |

| 73 | $59 | $116 | $173 | $288 |

| 74 | $61 | $120 | $179 | $297 |

| 75 | $62 | $123 | $184 | $306 |

| 76 | $65 | $128 | $191 | $317 |

| 77 | $67 | $132 | $197 | $328 |

| 78 | $69 | $136 | $204 | $338 |

| 79 | $71 | $41 | $210 | $349 |

| 80 | $73 | $145 | $216 | $360 |

Following this detailed breakdown of AARP’s life insurance rates, you may want to examine life insurance rates with Globe Life, and if interested, look further into Colonial Penn reviews for a comprehensive understanding of how its offerings might compare. By comparing the rates offered by Globe Life for similar age groups and coverage amounts, you can get a clearer understanding of how life insurance premiums vary between providers.

AARP 2022 Life Insurance Rates for Women (Ages 50-80)

| Age | $5K | $10K | $15K | $25K |

|---|---|---|---|---|

| 50 | $23 | $45 | $67 | $110 |

| 51 | $24 | $46 | $69 | $113 |

| 52 | $24 | $47 | $70 | $116 |

| 53 | $25 | $49 | $73 | $120 |

| 54 | $26 | $51 | $75 | $124 |

| 55 | $27 | $52 | $78 | $129 |

| 56 | $28 | $54 | $80 | $132 |

| 57 | $28 | $55 | $82 | $136 |

| 58 | $29 | $57 | $84 | $139 |

| 59 | $30 | $58 | $86 | $143 |

| 60 | $31 | $60 | $89 | $147 |

| 61 | $32 | $62 | $92 | $153 |

| 62 | $33 | $65 | $96 | $159 |

| 63 | $34 | $67 | $99 | $165 |

| 64 | $35 | $69 | $103 | $171 |

| 65 | $37 | $72 | $107 | $177 |

| 66 | $38 | $74 | $111 | $184 |

| 67 | $40 | $78 | $116 | $192 |

| 68 | $41 | $81 | $120 | $200 |

| 69 | $43 | $84 | $125 | $208 |

| 70 | $44 | $87 | $130 | $215 |

| 71 | $45 | $89 | $133 | $221 |

| 72 | $47 | $92 | $137 | $228 |

| 73 | $48 | $95 | $141 | $234 |

| 74 | $49 | $97 | $145 | $241 |

| 75 | $51 | $100 | $149 | $248 |

| 76 | $52 | $102 | $153 | $254 |

| 77 | $53 | $105 | $156 | $260 |

| 78 | $54 | $107 | $160 | $266 |

| 79 | $56 | $110 | $164 | $272 |

| 80 | $57 | $112 | $167 | $278 |