Globe Life sends frequent, eye-catching mailers.

Unfortunately, our praise for Globe Life doesn’t extend much beyond that.

Like Colonial Penn, Globe Life policies have major issues lurking beneath the surface.

Let’s see what that looks like in more detail.

Choose kindness.

You never know what battles people may be fighting.

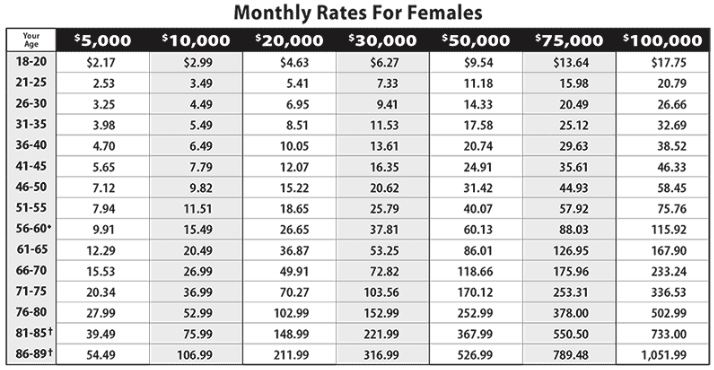

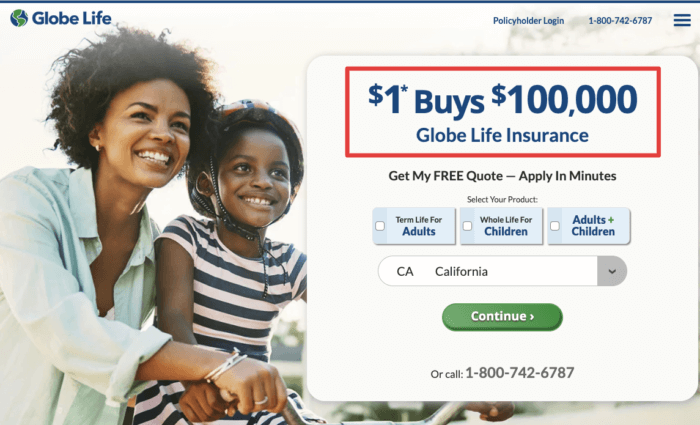

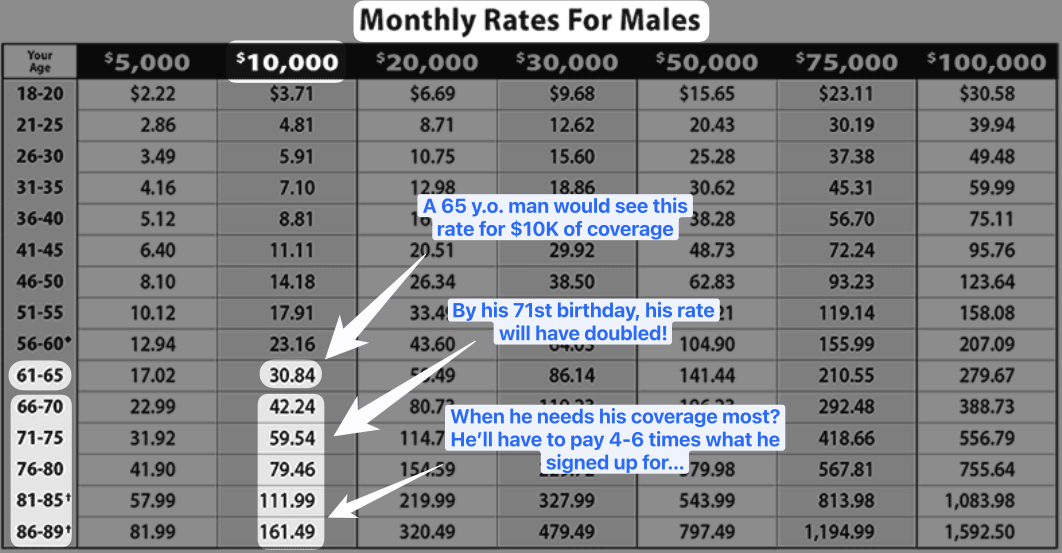

Globe Life Insurance Rates Chart (By Age & Gender)

The two rate charts below show Globe Life’s monthly life insurance rates by age, coverage amount, and gender.

Ironically, however, the footnotes to these charts tell you far more about how much Globe Life’s policies will cost you. Specifically:

- Your rates increase every five years

- Your policy is NOT “whole life insurance” (instead, it expires)

- If you’re above age 60, your coverage options are far more limited than they appear

Rate Chart Revelation #1: Your Globe Life Insurance Rate Increases Every Five Years

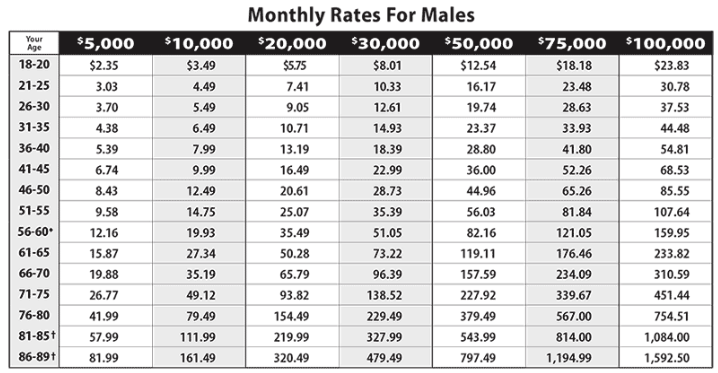

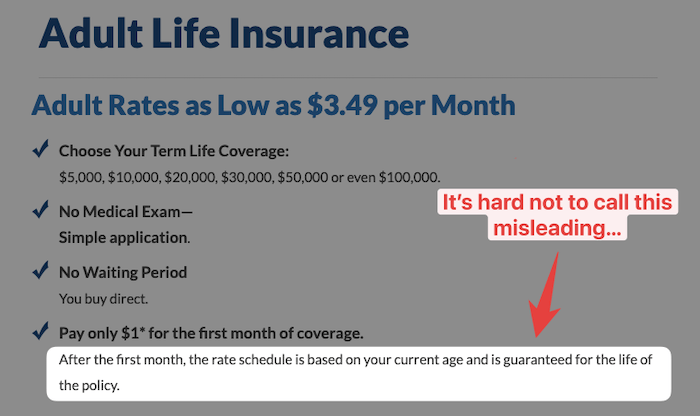

Take a look at the images below (both are screenshots from Globe Life’s life insurance home page: www.globelifeapplication.com).

It’s hard to say these are anything OTHER than misleading, right?

There’s hardly a mention of the actual rates for Globe Life insurance, and the one mention that is there is highly misleading.

From your initial rate check through the completion of your application, Globe Life does not tell you once that your rates will increase every five years.

And, as we’ll see below, these increases are not small either.

How Much Do Your Rates Increase With Globe Life?

The two tables below show how much Globe Life insurance prices CHANGE as you cross from one age bracket to another.

We can also see that the Globe Life insurance rates for adults depend on gender as well.

Table: Monthly Rate INCREASES For Women

| Age | $5K | $10K | $20K | $30K | $50K | $75K | $100K |

|---|---|---|---|---|---|---|---|

| 51-55 | $1 | $2 | $3 | $5 | $9 | $13 | $17 |

| 56-60 | $2 | $4 | $8 | $12 | $20 | $30 | $40 |

| 61-65 | $2 | $5 | $10 | $15 | $26 | $39 | $52 |

| 66-70 | $3 | $7 | $13 | $20 | $33 | $49 | $65 |

| 71-75 | $5 | $10 | $20 | $31 | $51 | $77 | $103 |

| 76-80 | $8 | $16 | $33 | $49 | $83 | $125 | $166 |

| 81-85 | $12 | $23 | $46 | $69 | $115 | $173 | $230 |

| 86-89 | $15 | $31 | $71 | $95 | $159 | $239 | $319 |

Table: Monthly Rate INCREASES For Men

| Age | $5K | $10K | $20K | $30K | $50K | $75K | $100K |

|---|---|---|---|---|---|---|---|

| 51-55 | $1 | $2 | $4 | $7 | $11 | $17 | $22 |

| 56-60 | $3 | $5 | $10 | $16 | $26 | $39 | $52 |

| 61-65 | $4 | $7 | $15 | $22 | $37 | $55 | $74 |

| 66-70 | $4 | $8 | $16 | $23 | $38 | $58 | $77 |

| 71-75 | $7 | $14 | $28 | $42 | $70 | $106 | $141 |

| 76-80 | $15 | $30 | $61 | $91 | $152 | $227 | $303 |

| 81-85 | $16 | $33 | $66 | $99 | $165 | $247 | $329 |

| 86-89 | $24 | $50 | $101 | $152 | $254 | $381 | $509 |

Example: 65-Year-Old Male

Globe’s insurance payment rate chart for males shows that a 65-year-old would pay $30.84 for $10,000 of coverage.

On the surface, that looks like a much better deal than the $56 per month rate he would see from a traditional insurance company like Aetna or Mutual of Omaha.

But here’s the reality of his Globe Life insurance cost:

- After just 5 years, his Globe Life payment rate will be higher than his (flat) Aetna rate

- After 10 years, his Globe rate will be $79/month

- After 20 years… $161/month

In total, he will pay $8,966 more with Globe Life (vs. Aetna) by the time his Globe Life policy expires.

People typically don’t learn of this until years later, when their rate has become unaffordable.

At that point, they are in a no-win situation. Given their health and older age, their other coverage options are limited (at best). But then again, they can’t pay for something with money they don’t have.

So, they have no choice but to cancel their policy, and their loved ones may have no choice but to put thousands on a credit card.

Meanwhile, Globe walks away with years of their hard-earned dollars and doesn’t even have to pay them a cent of cash value in return.

Choose kindness.

You never know what battles people may be fighting.

Rate Chart Revelation #2: Your Policy Expires

The second important factor that Globe Life’s life insurance rate chart reveals is that their policies expire.

If you buy a $10,000 policy at age 65, you will pay $25,715 to Globe by your 90th birthday. If you pass a day later, you get nothing.

Rate Chart Revelation #3: Your Coverage Options With Globe Life

The final factor that Globe Life rates chart reveals is the amount of coverage you can get with Globe Life.

Globe Life covers residents of all 50 states, ages 18 to 80.

You can buy coverage in the following amounts:

- $5,000

- $10,000

- $15,000

- $20,000

- $30,000

- $50,000

- $75,000 (N/A to ages 60+)

- $100,000 (N/A to ages 60+)

Globe Life Insurance Rate Chart FAQs

Does Globe Life insurance go up every year?

Globe Life insurance rates go up every five years. Or more precisely, every time you hit one of these ages: 21, 26, 31, 36, 41, 46, 51, 56, 61, 66, 71, 76, 81, 86. Policies expire when you turn 90, so there are no further price increases after age 86.

What are Globe Life rates?

You can find a full Globe Life rate chart, for both men and women ages 18-89, at the beginning of this article. Rates can be as low as $3.50 per month for $10,000 of coverage for an 18-20 year-old, all the way up to $604.75 per month for $50,000 of coverage for an 86-89 year-old.

Is Globe Life a ripoff?

We can say with 100% certainty that Globe Life is a ripoff. And it’s not a surprise really. Someone has to pay for their huge marketing budget, after all! To see what fair burial insurance rates look like, check out our new price quoter.

Choose kindness.

You never know what battles people may be fighting.

Conclusion

We hope you found this overview of Globe Life’s insurance rates helpful.

If you have any questions, please don’t hesitate to leave a comment.

Warm Regards,

The GetSure Team

Article Sources

- Globe Life. Globe Life Application

- Globe Life. Final Expense Insurance

looking for the most affordable whole life insurance for 5 year

Hi Esther — absolutely, we have a few options that might interest you. I’ll send you an email now.