No fluff, just logic.

A burial insurance plan will be worth it for you if the benefits are greater than the costs.

Check out the reasons below and decide if your pros outweigh your cons.

Choose kindness.

You never know what battles people may be fighting.

Whole Life Insurance: A Quick Refresher

Before we go any further, let’s define what the product is in the first place.

Whole life policies last your “whole life” (which is why they are sometimes called permanent coverage).

The other major type of life insurance is term life insurance, which terminates after a set period. The two main features of whole life insurance are the following:

- Permanent coverage

- Cash value account

Permanent coverage means your beneficiaries will receive a payout no matter when you pass.

The cash value account is a savings account that grows tax-deferred inside the policy. You can access the cash value through loans or withdrawals, but it will reduce the death benefit if you do not repay the loan.

Features Common To All Whole Life Policies

Burial insurance companies will try to sell you on benefits common to all life insurance policies. For example:

- “Your premiums will never increase.”

- “Your benefits will never decrease.”

- “The policy builds cash value”

Don’t get fooled by these claims.

You will find these features in ANY whole life insurance policy, so don’t think they are specific to your burial insurance policy (also called funeral insurance or final expense insurance).

Check Out: Key Features of the State-Regulated Life Insurance Program

The Three Hallmarks Of Burial Insurance

A burial insurance policy is a type of whole life insurance policy.

Burial insurance is called “final expense insurance” or “funeral insurance” for a reason: people use these policies to fund their final, end-of-life expenses, and the biggest of these is the cost of a funeral!

3 things make burial policies different from standard whole life policies:

- Smaller payouts (less than $40K)

- More convenient application

- Easier to get approved

So the question is… Who values these three features most?

Choose kindness.

You never know what battles people may be fighting.

5 Reasons You Should Buy Funeral Insurance

Now that we’ve established what burial insurance policies product is at its core let’s look at who needs its three distinguishing features.

You currently have less than $10,000 saved.

I know what you’re thinking… “I may be able to save that much by the time I pass, so maybe I don’t need burial insurance?”

If only we knew when we would pass! As you know, however, the unexpected could happen tomorrow. The great thing about insurance is that it gives you that entire lump sum, which would have taken you years to save immediately!

So instead, consider getting a burial policy. And then, as your savings grow and approach your needs, cancel your policy! It served its purpose by covering you during the years that your savings could not.

Your end-of-life expenses will burden your loved ones

Perhaps the best reason to get burial insurance coverage is to pay your own way. If you wouldn’t walk out of a restaurant and leave your children with the bill, then why do it with a larger amount?

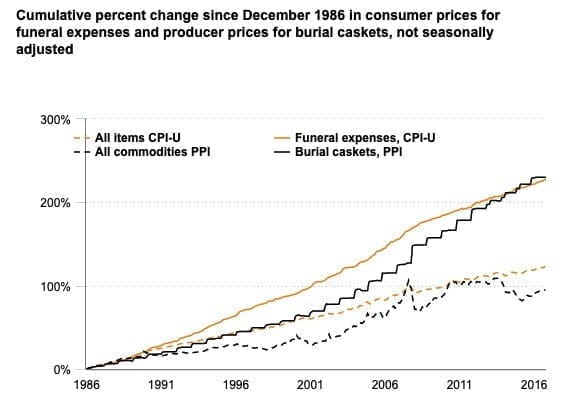

You want to have a traditional funeral service and burial

Funeral expenses have gone through the roof over the past 20-30 years. Average The national average of funeral and burial costs now exceeds $10,500.

You are in poor health (e.g., with a chronic or terminal illness)

Even if you’ve been in good health for most of your life, things can unfortunately change at the drop of a hat. If you find yourself with serious health conditions (e.g., cancer, COPD, diabetic complications, or even a terminal illness), there is a type of final expense policy, called guaranteed acceptance life insurance (also known as guaranteed issue life insurance), which will cover you, no medical exam, no health questions asked.

The only downside here is that you will have to pass through a “waiting period” before your life insurance company will pay out your full death benefit amount (your life insurance money). Most final expense policies of this variety have a two-year waiting period, but a few carriers require three years.

Your passing will mean lost income for your family

This need is often the reason younger individuals purchase traditional whole life insurance or other life insurance policies.

5 Reasons NOT To Buy Final Expense Insurance

Now that we’ve established what burial insurance policies product is at its core let’s look at who needs its three distinguishing features.

You cannot afford a policy.

The best reason NOT to buy final expense life insurance is if you cannot afford it. If you’re unsure of whether your burial insurance cost will fit within your budget, you’re better off not buying. Otherwise, you may “lapse” on your policy due to non-payment. In this case, you would have paid your burial insurance premiums to your life insurance company for nothing.

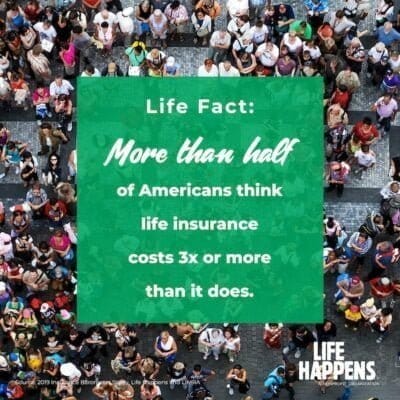

BUT, we would be remiss if we didn’t mention that the majority of Americans overestimate the cost of life insurance by 300% on average, according to a 2019 LIMRA study.

You have more than $10,000 saved.

The best reason not to buy a policy is if you do not need one! If you have more than $10K saved, your savings should cover funeral expenses, according to the latest report by the National Funeral Directors Association. You should not need burial insurance if you won’t have outstanding unpaid medical bills or other debt when you pass.

You do not have strong views about your final arrangements

There is nothing wrong with donating your body to science; this type of final arrangement is completely free! Without needing to cover funeral costs, it’s not worth it for you to pay monthly funeral insurance premiums, just in case you end up having unpaid medical bills when you pass.

You are in excellent health!

In recent years, the visibility of life insurance products has increased significantly, thanks in part to Open Care TV ads. These advertisements often highlight the ease of obtaining life insurance, including burial insurance, without a medical exam for those in good health. While these ads can provide valuable information about insurance options, it’s crucial to conduct thorough research and consult with a financial advisor to ensure that the insurance product meets your specific needs and financial situation.

If you are in excellent health (no health issues, and of course, no chronic or terminal illness), you should consider getting fully underwritten, traditional life insurance coverage from insurance companies like Mutual of Omaha.

Unlike these policies, you WILL have to take a medical exam. However, if everything comes back okay, then you’re very likely to be able to get a cheaper policy than the burial insurance plans that use simplified underwriting.