- 93 Companies reviewed

- 50 Features considered

- 4,650 Data points analyzed

We collected 4,650 data points from 93 life insurance companies to measure financial stability, customer satisfaction, product and feature variety, and the overall buying experience. We then evaluated each company based on 50 metrics to develop unbiased, comprehensive reviews.

Choose kindness.

You never know what battles people may be fighting.

Who Is Prosperity Life Insurance Group?

Prosperity Life Insurance Group is a life insurance company with over 300,000 outstanding policies, with an aggregate of $4.2 billion in assets as of 2020 year-end.

Prosperity holds an A- (Excellent) A.M. Best financial strength rating.

| Attribute | Details |

|---|---|

| Founded | 1916 |

| Address | 100 W. 33rd Street, Suite 1007 New York, NY 10001 |

| NA | |

| Phone | ( |

| Website | https://www.prosperitylife.com/ |

| BBB Rating | A+ |

| A.M. Best Rating | A- (Excellent) |

Member Companies

Prosperity Life Group provides its products through its three member companies: Shenandoah Life Insurance Company, SBLI USA Life Insurance Company, and S.USA Life Insurance Company Inc.

For the final expense plans we will discuss below, the issuer is S USA Life Insurance Company in all states except New York. In New York, the New Vista product line is called “Golden Promise” and is issued by SBLI USA Life Insurance Company.

Check out: Is Americo Life Insurance Worth It?

Prosperity Final Expense Life Insurance Offerings

Prosperity’s final expense insurance offerings come under its “New Vista” brand of whole life insurance policies.

New Vista burial insurance policies come in three plan types: level, Graded, and Modified. All of these plans are “simplified issue” (meaning much quicker underwriting). Whether or not you are approved for a specific plan will depend on your current health.

The key difference between these plans concerns the amount and timing of the death benefit payout. We’ll discuss this in more detail below.

New Vista Level Benefits

The most straightforward policy is the Level Benefits plan.

With this plan, there is no “waiting period” before you are eligible for your death benefit payout. If you die the day after you buy your policy, your beneficiary will receive a full payout of your death benefit (also known as the “face amount” of the policy).

For New Vista Level and the other two plan types, the minimum coverage offered is $1.5K and the maximum coverage you can buy is $35K.

All with no medical exam and no more than one phone call.

To be eligible to apply, you must be a U.S. resident between 50 and 80 years old. All plans have level premiums and high third-party ratings.

New Vista Graded Benefits

If you are not in perfect health, but still insurable, you may be approved for the Graded Benefits plan.

As you can see from the above, the only major difference between this plan and the Level Benefits plan is the two-year waiting period.

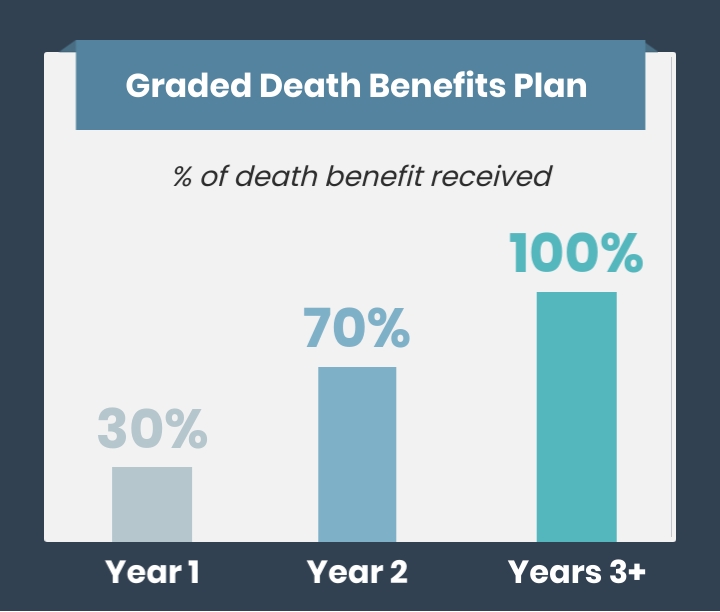

If you die during the first two years of the policy, Prosperity will NOT pay out the full death benefit. For this plan, they will pay:

- 30% of the policy’s face value if the insured dies during the first year of the policy

- 70% if the insured dies within the second year of the policy

- 100% (the full amount) if the insured dies in years three or later. The Graded plan = the Level plan after Year 2

As with any graded benefits final expense life policy, the waiting period does NOT apply to accidental deaths. In other words, the policy’s contractual obligations dictate that it will pay out 100% if you die as a result of an accident, even if that occurs within the first two years.

New Vista Modified

Prosperity’s third and final burial insurance plan is its New Vista Modified product.

Again, the only difference is in terms of how the death benefit is paid out:

- During the 1st year of coverage, the death benefit = 110% of your annual premium

- During the 2nd year of coverage, the death benefit = 231% of your annual premium

- After year 2, the death benefit = 100% of the face amount of the policy

As mentioned above, the full death benefit is always paid for accidental deaths, no matter when they occur.

Finally, most note that the coverage amounts do not change for the modified plan

Available Riders

Prosperity has two policy riders available.

Accelerated Death Benefit Rider

The first is an “Accelerated Death Benefit” rider, included in the policy for all three plan types.

With this rider, if you are diagnosed with a terminal illness, you may be able to access between 25-50% of your coverage amount while you are living. Hospital bills aren’t cheap, so this rider can be a family lifesaver.

Accidental Death Benefit Rider

The second rider offered is an “Accidental Death Benefit” rider.

This rider is available to customers of all three plan types, but it is NOT included by default. (It can be purchased for a small fee).

This rider is available only to those between 50 and 74 (and the rider expires at age 75).

The amount of accidental death coverage you will receive will equal the face value of your original policy.

Choose kindness.

You never know what battles people may be fighting.

Prosperity Life Insurance Application & Underwriting

Let’s now dig into the “how” of buying a life insurance policy from Prosperity.

The Underwriting Decision

Prosperity’s underwriting decision, similar to American Amicable’s, will be based on your answers to the application health questions, your MIB report, and a check of your prescription drug history.

You must also fall within specific height and weight ranges to qualify.

Underwriting Results

There are three possible outcomes once you’ve submitted your Prosperity life insurance application:

- The policy is approved as applied for (Level, Graded, or Modified). In this case, you’ll be able to buy your policy on the spot

- The underwriter informs you that you are not eligible for coverage (based, e.g., on the answers to the health questions)

- Finally, while this is rare, your application may require additional underwriter review. In this case, it will be processed by the Home Office, and a decision will be communicated to you within 1-2 weeks

Billing Options

Prosperity accepts the following payments options:

- EFT

- Direct Express

- Direct Bill (excluding monthly)

Payment draft dates can be a specific date (day 1-28 of the month), can be the same as the policy effective date, or can occur on the 2nd, 3rd, or 4th Wednesday of the month.

Conclusion

We hope you enjoyed this review of Whole Life Prosperity Life Insurance Group.

While Prosperity’s premium rates may not be as low as the likes of Mutual of Omaha and Liberty Bankers, they have distinct underwriting advantages that will make them the leading provider for many customers.

If you are concerned about the impact your final expenses may have on your loved ones, please don’t hesitate to reach out to us and we’ll be happy to talk you through which life insurance products may be right for you.

Warm Regards,

The GetSure Team

Article Sources

- Final Expense Whole Life Insurance. Prosperity Life