In this guide, we’ll take a detailed look at the cost of a million dollar life insurance policy for both men and women at a wide range of ages.

We looked at what 11 life insurance companies would charge for a 20-year term life insurance policy with this amount of coverage. These companies varied from start-up, online-first agents to veteran, established insurance carriers.

To our surprise, a single company emerged as the clear winner and we’ll walk you through how we got there, starting with some background context below.

Choose kindness.

You never know what battles people may be fighting.

Who Needs A Million Dollars Of Life Insurance?

A cool $1 million wired to you from your life insurance company.

That’s a lavish amount of wealth when we think of it as disposable income, to spend freely at our heart’s desire.

When it comes to a life insurance policy’s payout (or “death benefit”), however, it’s almost entirely the opposite.

As we’ll see, a million dollars in life insurance coverage is not at all extravagant. Instead, for many American families, it’s the responsible amount of coverage to carry.

The Purpose Of Life Insurance Coverage

Here’s why you have to think about the death benefit payout from a life insurance policy differently.

When it comes to life insurance, the intent of the death benefit is to pay for:

- Existing financial obligations (e.g., your home mortgage or student loans, or college tuition expenses for your children)

- Required living expenses

It’s by no means intended to pay for a new car or to splurge on a vacation.

A life insurance payout makes up for the [future] income you lose when your loved one passes away. It’s meant to replace, not add to your finances.

How Much Life Insurance Coverage Do You Need?

So what’s the right amount of coverage to buy?

Well, a precise estimate would require a full picture of your future finances. For example, living expenses projected for 10+ years, future financial obligations, and other items that are clearly impossible to know with certainty.

… Using A Rule Of Thumb

So clearly, this is not an exact science.

And given how many moving parts there are (especially for younger families), it’s often preferable to use a rule of thumb that’s survived the test of time in the life insurance industry:

To estimate your family’s life insurance coverage need, multiply your annual household income by 10-12.

… Using A Life Insurance Calculator

For those who (proudly) micro-manage their personal finances, there are several good tools online that can help you estimate your coverage needs on an item-by-item basis.

(My favorite is this insurance needs calculator from LifeHappens.org.)

How We Conducted Our Analysis

Before we get into the actual cost of the policy, let’s review the information used in generating the rate quotes shown below. Specifically:

- The life insurance product quoted

- The companies surveyed

- The demographics assumed (age, gender, and health)

1. The Product: 20-Year Term Insurance

There are two types of life insurance: term life insurance and permanent life insurance coverage.

As its name suggests, permanent life insurance provides coverage for the rest of the policyholder’s life. Whether you live one year or 100 years after you buy the policy, your life insurance company will pay your beneficiaries your policy’s death benefit when you die.

On the other hand, a term life insurance policy covers the insured for a pre-set period of time, which is referred to as the “term” of the policy.

Once all of these obligations have been met, their need for life insurance is significantly reduced.

2. The Companies: 15 Online & Traditional Insurers

We collected quotes from 15 life insurance companies in total.

We separated these companies into two broad groups: those that offer a 100%-online buying process vs. more “traditional” life insurers, which distribute their products through agents.

100% ONLINE TERM LIFE INSURERS

- Health IQ

- Bestow

- Ethos Life

- Fabric Life Insurance

- Haven Life (MassMutual)

TRADITIONAL

- Equitable Life

- John Hancock

- Legal & General (Banner Life)

- Mutual of Omaha

- Pacific Life

- Principal Financial

- Protective Life

- Prudential

- SBLI

- Securian Financial

3. The Demographics Assumed

To get each life insurance quote below, we had to answer high-level demographic questions related to the insured’s age, gender, and health.

With regard to gender, we split men and women into separate tables (found in the next two sections, respectively). And re: age, the table columns reflect the five ages we surveyed: 30, 40, 50, 60, and 65 years.

Finally, we answered the health questions assuming a policyholder in good health. This implied the following characteristics:

- Non-smoker (i.e., no tobacco or e-cigarette use in the past 60 months)

- Healthy or average build (i.e., Body Mass Index < 30)

- No current medications for cholesterol or blood pressure

- No immediate family have died from cancer, diabetes, or heart disease before the age of 65

Note: Many life insurance companies use health questions like these to give customers a ballpark estimate of their rate. When the policy is fully underwritten, however, most insurers will require a medical exam to have more precise, quantitative health information upon which they can make approval and pricing decisions.

Check Out: How Much is $5,000 of Life Insurance?

Check Out: $10K Term Life Insurance Rates

Check Out: AARP Life Insurance Rates Overview

Choose kindness.

You never know what battles people may be fighting.

$1 Million Life Insurance Premiums: Men

Now for the good stuff: actual life insurance quotes (from Quotacy.com) for the 11 companies we surveyed.

We’ll look at the cost for male policyholders in this section and females in the following section.

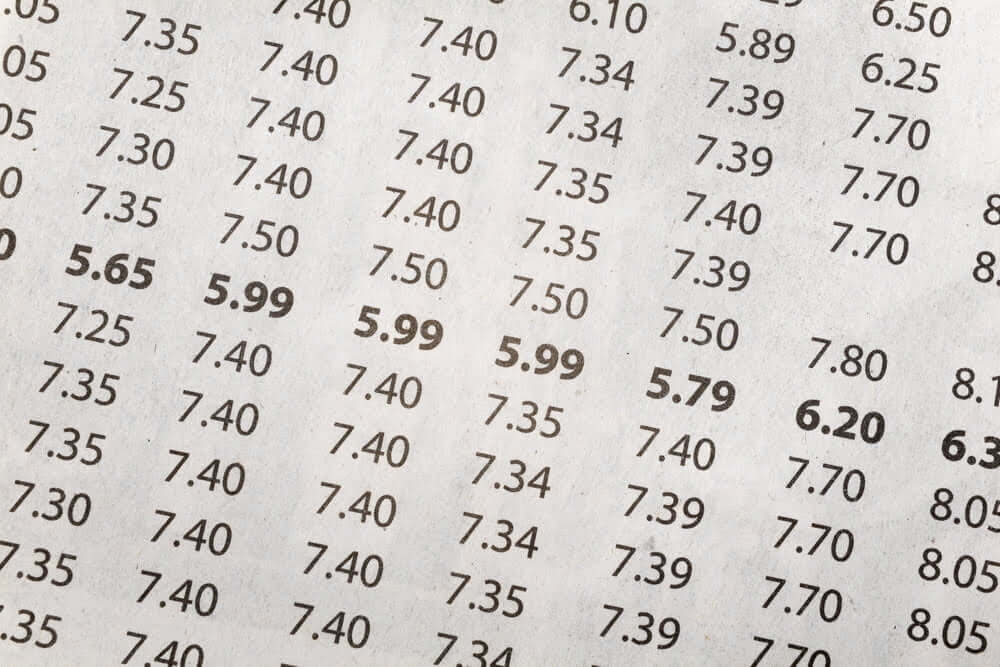

Male Life Insurance Rates (Ages 30-65) For A $1 Million Policy

Takeaway #1: Rates Increase Sharply With Age

From these prices, there are two key takeaways.

Monthly rates increase sharply with age.

Taken over the 15 insurance companies shown above, the average cost for 20 years of coverage was:

- 30-year-old: $30 per month or $7,200 in total

- 40-year-old: $50 per month or $12,000 in total

- 50-year-old: $115 per month or $27,600 in total

- 60-year-old: $300 per month of $72,000 in total

- 65-year-old: $550 per month or $132,000 in total

Takeaway #2: Online Convenience Has A Price

Second, the three “100%-online” life insurance brokers (Bestow, Ethos, and Fabric) charged considerably higher monthly premiums than the traditional life insurance carriers.

(And these three digital insurers were also the most restrictive when it came to age. Bestow doesn’t offer 20-year term policies to 50-year-olds, and none of them offer 20-year term policies to those above 60.)

There are two types of people who will find this worth it:

The first group, of course, is people who value the convenience of doing everything quickly and 100% online.

The second group is the procrastinators.

Our Recommendation

Given how quickly you can purchase a policy online (< 15 minutes), we would recommend purchasing one ASAP so that you have some coverage.

Then, if the price is too high to maintain, buy a fully-underwritten policy in the near future. As soon as you are issued this policy, cancel the one purchased online. If you do so within 30 days, you will even get a full refund of your first premium payment — giving you up to a month’s worth of coverage for free!

Note that you will have to take a medical exam for the fully-underwritten policy, but you may find the cost savings worth it.

$1 Million Life Insurance Premiums: Women

And now for the women, the rates that you’ve been waiting for.

The table below shows the monthly premiums for 30- to 65-year-old women for a million-dollar policy, as quoted by each of the 11 companies below.

Female Life Insurance Rates (Ages 30-65) For A $1 Million Policy

Takeaway #1: Female Longevitity = Lower Prices

Rates offered to women are significantly lower than those offered to men, reflecting the difference in life expectancy between the two genders.

Frequently Asked Questions

How much does a $1 million policy cost for a 40-year-old woman?

From Lincoln, you can get a $1 million policy for $48.47 per month if you are a 40-year-old woman in the highest ratings class.

Are online life insurance companies legit?

Online life insurance companies like Bestow, Ethos Life, Fabric, Health IQ, and Ladder Life are 100% safe to buy from. While the companies themselves are new, they are just brokers. The Company issuing you your policy (in each of these cases) is a well-established life insurance carrier with an A or A+ rating (for claims-paying ability) from A.M. Best.

How much does a $1 million policy cost for a 40-year-old man?

From Protective you can get a $1 million policy for $50.07 per month if you are a 40-year-old man in the highest ratings class.

Choose kindness.

You never know what battles people may be fighting.

Conclusion & Recommendations

Here’s the bottom line.

Giving insurance companies more information about your health and lifestyle allows them to learn that you are a lower-risk applicant. And this, in turn, allows them to offer you a lower monthly premium rate.

Without this level of detail, insurers use broader, demographic-wide data to make assumptions about your health and lifestyle. Because they take on additional risks in doing this, they have to charge you a higher premium.

Our Recommendations

If you are dangerously under-covered at the moment or if you don’t mind spending ~$10 more per month to avoid traditional insurer’s longer application process of a traditional insurer, then we highly recommend going with one of the three online carriers (we recommend Health IQ, and you can find our full review of each of them here: Bestow, Fabric, and Health IQ).

If that’s not a worthwhile trade-off for you, go with one of the traditional carriers in the above rate table. We highly recommend Haven Life (the online face of MassMutual), the only traditional carrier that offers a 100% online application.

If you have any questions, don’t hesitate to leave a comment or shoot us an email at hello [at] getsure.org.

Warm Regards,

The GetSure Team

Article Sources

- Quotacy. Term Life Insurance Quotes